Latest News

Via Benzinga · January 23, 2026

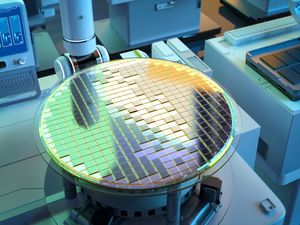

Valued at $13.6 billion, Nova is a provider of metrology solutions for advanced process control used in semiconductor manufacturing.

Via Talk Markets · January 23, 2026

Microsoft Corp (NASDAQ: MSFT) is trading higher on Friday. The company landed a major U.S. government contract and unveiling a new robotics-focused AI model. Here's what you should know.

Via Benzinga · January 23, 2026

Silver prices have skyrocketed to $100/oz in 2026 due to growing demand and 4 consecutive years of deficits. Industrial use and geopolitical tension also contribute. 3 top silver stocks to invest in.

Via Benzinga · January 23, 2026

Crombie REIT benefits from a high-quality, necessity-based retail portfolio, anchored by grocery and pharmacy tenants, which supports stable occupancy, long lease terms, and predictable cash flow.

Via Talk Markets · January 23, 2026

Silver ETFs are carving out a new role in 2026 as AI-driven industrial demand collides with market volatility, Fed rate-cut bets and geopolitical stress.

Via Benzinga · January 23, 2026

Via Benzinga · January 23, 2026

You're not doomed to lose out on buying power.

Via The Motley Fool · January 23, 2026

California Attorney General Rob Bonta on Friday filed a lawsuit against the Trump Administration, challenging the Pipeline and Hazardous Materials Safety Administration’s (PHMSA) orders of allowing Sable Offshore’s two pipelines to restart operations.

Via Stocktwits · January 23, 2026

There is growing legitimate concern about the silver supply on more than just a short-term basis.

Via Talk Markets · January 23, 2026

Super League Enterprise, Inc. (NASDAQ:SLE) shares are down on Friday after the advertising company announced an exclusive partnership with Solsten to enhance its audience intelligence capabilities.

Via Benzinga · January 23, 2026

Exploring the top movers within the S&P500 index during today's session.chartmill.com

Via Chartmill · January 23, 2026

Via Benzinga · January 23, 2026

Prime Minister Mark Carney earned the praise of world leaders at the World Economic Forum in Davos, however with one glaring exception, President Trump.

Via Talk Markets · January 23, 2026

Via Benzinga · January 23, 2026

Ferrari's stock is cheaper than it's been in many years.

Via The Motley Fool · January 23, 2026

Via Benzinga · January 23, 2026

Via Benzinga · January 23, 2026

Via Benzinga · January 23, 2026

Via Benzinga · January 23, 2026

Via Benzinga · January 23, 2026

Via Benzinga · January 23, 2026

Via Benzinga · January 23, 2026

IBKR avoids sports betting in prediction markets while Robinhood doubles down, as state regulators crack down on sports contracts.

Via Benzinga · January 23, 2026

What's going on in today's sessionchartmill.com

Via Chartmill · January 23, 2026

A number of stocks fell in the afternoon session after Intel reported disappointing earnings report and weak forecast for the current quarter.

Via StockStory · January 23, 2026

Shares of data analytics company Palantir Technologies (NASDAQ:PLTR) jumped 2.6% in the afternoon session after a series of positive developments, including a major new deal and an analyst upgrade, fueled investor optimism ahead of its earnings report.

Via StockStory · January 23, 2026

Shares of footwear conglomerate Wolverine Worldwide (NYSE:WWW)

fell 7.3% in the afternoon session after Exane BNP Paribas analyst Laurent Vasilescu downgraded the stock and significantly cut the price target.

Via StockStory · January 23, 2026

Shares of enterprise workflow automation company ServiceNow (NYSE:NOW) jumped 3.5% in the afternoon session after it shook off broader market volatility as sentiment improved following the announcement of a significant expansion of its strategic partnership with OpenAI to integrate advanced "agentic AI" capabilities directly into its enterprise platform. The deal promised to move beyond simple chatbots, allowing AI agents to autonomously execute complex workflows across business systems. This announcement captured the attention of investors, placing the company at the forefront of the next generation of automated enterprise software.

Via StockStory · January 23, 2026

Shares of aerospace and defense company Redwire (NYSE:RDW)

jumped 10.2% in the afternoon session after President Trump announced progress on the 'Golden Dome' initiative, a project with strategic importance in Greenland and the Arctic.

Via StockStory · January 23, 2026

Shares of cloud communications provider Bandwidth (NASDAQ:BAND) jumped 6.5% in the afternoon session after B. Riley Securities initiated coverage on the stock with a 'Buy' rating and a $20 price target.

Via StockStory · January 23, 2026

Shares of technology giant Microsoft (NASDAQ:MSFT) jumped 4% in the afternoon session after a UBS analyst reiterated a Buy rating with a $600 price target.

Via StockStory · January 23, 2026

Shares of aerospace and defense company Rocket Lab (NASDAQ:RKLB)

jumped 4.3% in the afternoon session after several analysts upgraded the stock or raised their price targets, following the company's first successful launch of 2026.

Via StockStory · January 23, 2026

Shares of regional banking company Banner Corporation (NASDAQ:BANR) fell 6.1% in the afternoon session after the company reported mixed fourth-quarter 2025 financial results, where a revenue shortfall overshadowed an earnings beat.

Via StockStory · January 23, 2026

A number of stocks fell in the afternoon session after Intel reported disappointing earnings report and weak forecast for the current quarter.

Via StockStory · January 23, 2026

Sable Offshore Corp. (NYSE:SOC) shares are down on Friday following a lawsuit filed by California Attorney General Rob Bonta against the Trump Administration to block the restart of oil transport through the Sable Pipeline.

Via Benzinga · January 23, 2026

Silver has more than tripled in value over the past year, but gold has historically bigger gains. Which precious metal should you consider now?

Via Barchart.com · January 23, 2026

What makes Micron’s investment case more compelling is the disconnect between MU stock's price and its projected earnings power.

Via Barchart.com · January 23, 2026

Gold surges by over 1% as intervention rumors boost the Japanese Yen and drag the US Dollar to multi-month lows.

Via Talk Markets · January 23, 2026

These two consumer brands might be drawing in completely different investor groups.

Via The Motley Fool · January 23, 2026

Intel's guidance disappointed the market. Is the turnaround story still alive?

Via The Motley Fool · January 23, 2026

GitLab stock has crashed in the past few months, mirroring the performance of other software companies.

Via Talk Markets · January 23, 2026

Via MarketBeat · January 23, 2026

The global financial landscape has undergone a seismic shift as 2025 closed with merger and acquisition (M&A) volumes surpassing a staggering $5 trillion. This "M&A Renaissance" marks a definitive end to the deal-making drought that plagued 2023 and much of 2024, signaling a return to bold, transformative corporate

Via MarketMinute · January 23, 2026

The market delivered a strong gain in 2025, but it was no match for these stock picks.

Via The Motley Fool · January 23, 2026

TOKYO – The bedrock of the global financial system is shifting. On January 23, 2026, the Japanese government bond (JGB) market—long a bastion of low volatility and near-zero rates—is grappling with a historic "market rebellion." The yield on the benchmark 40-year JGB surged to 4.24% this week, decisively

Via MarketMinute · January 23, 2026