Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

Value-oriented investors may find that WLKP’s current pricing reflects headline fear rather than cash-flow reality.

Via Talk Markets · February 6, 2026

China’s inflation data is likely to cool in January.

Via Talk Markets · February 6, 2026

Gold rebounds as weak U.S. labor data and growing Fed rate cut bets lift sentiment.

Via Talk Markets · February 6, 2026

The S&P 500 is now down in 2026, and two of the eleven sectors are up by double digits.

Via Talk Markets · February 6, 2026

Bitcoin is back in the headlines after the world’s largest cryptocurrency tumbled sharply on Thursday, briefly slipping below $61,000.

Via Talk Markets · February 6, 2026

Gold looks for the next fundamental signal as price action continues its volatile road.

Via Talk Markets · February 6, 2026

Surging volatility across assets has a margin-call feel, highlighting the need for tight risk control and live market guidance.

Via Talk Markets · February 6, 2026

The US dollar is seeing this week’s gains pared against most of the G10 currencies today.

Via Talk Markets · February 6, 2026

After plummeting from $73,000 to $60,000, panic is sweeping the market.

Via Talk Markets · February 6, 2026

The company adds significant capital from a healthcare institution fund while making meaningful regulatory progress on novel therapeutic candidate.

Via Talk Markets · February 6, 2026

The market got off to a strong start in 2026, with investors chasing industrials, materials, and commodity-related stocks as the reflation narrative gained traction.

Via Talk Markets · February 6, 2026

Despite short-term exhaustion, USD/JPY remains in a strong uptrend, with interest rate differentials favoring buyers on pullbacks toward key support zones.

Via Talk Markets · February 6, 2026

Amazon stock slides 8% premarket as AI spending concerns grow

Via Talk Markets · February 6, 2026

We live in an era of momentum investing. Value investing – especially deep value investing – is out of fashion. As a result, nobody is interested in PayPal.

Via Talk Markets · February 6, 2026

A sharp sell-off has shaken the tech sector, hitting software stocks and cryptocurrencies amid weak labour market data and doubts about AI-driven valuations.

Via Talk Markets · February 6, 2026

EUR/USD remains capped below 1.1800, with 1.1765 low at hand.

Via Talk Markets · February 6, 2026

Gold on Friday was at 4800 USD per troy ounce. It remains in a vulnerable position after declining 3.8% the day before and is moving towards its second consecutive weekly drawdown.

Via Talk Markets · February 6, 2026

Crypto markets have been back in the spotlight on a global scale as losses have intensified in recent days.

Via Talk Markets · February 6, 2026

European markets are in a largely upbeat mood this morning despite the volatility that has been evident across the spectrum of financial assets this week.

Via Talk Markets · February 6, 2026

The yen has been weakening this week, with the USDJPY once again trending towards levels that have sparked intervention in the past.

Via Talk Markets · February 6, 2026

The stress observed in cryptocurrencies and silver is not a mere epiphenomenon: it is the first sign of a market regime that is beginning to strain beneath the surface.

Via Talk Markets · February 6, 2026

The Pound has seen gains against the dollar erased as the pair continues to sell off.

Via Talk Markets · February 6, 2026

Bearish momentum dominates as the market tests major support at November’s lows and December’s lows. This video highlights a

Via Talk Markets · February 5, 2026

The oil markets had a negative day today.

Via Talk Markets · February 5, 2026

December's retail sales and industrial data were disappointing – but we think a potential upturn is closer than ever.

Via Talk Markets · February 6, 2026

Bitcoin faced a severe downturn on Thursday, as its value plunged beneath the $65,000 threshold, briefly touching $60,000 in late trading.

Via Talk Markets · February 6, 2026

The BSE Sensex closed higher by 266 points (up 0.3%)..Meanwhile, the NSE Nifty closed 50 points higher (up 0.2%).

Via Talk Markets · February 6, 2026

Amazon reported its earnings, and traders responded with a nasty sell-off.

Via Talk Markets · February 6, 2026

Bitcoin dropped below $70,000 for the first time since October 2024, losing about a quarter of its value since the start of the year amid a massive reduction in speculative positions across the risk asset spectrum.

Via Talk Markets · February 6, 2026

As the geopolitical map of South American oil shifts in early 2026, the contrast between Guyana and Venezuela has never been starker.

Via Talk Markets · February 6, 2026

The Pound Sterling bounces back against its major currency peers, recovering some of the previous day’s losses.

Via Talk Markets · February 6, 2026

Gold remains volatile after testing $5,000, with $4,800 acting as support as traders await a decisive close to confirm the uptrend’s next phase.

Via Talk Markets · February 6, 2026

Growth stocks have become significantly cheaper since the beginning of the year, and at some point will provide a compelling entry point to add to holdings.

Via Talk Markets · February 6, 2026

Widespread financial meltdown continued again today, slamming crypto, silver, and private credit particularly hard.

Via Talk Markets · February 6, 2026

Markets open with FX largely steady and sterling firmer, but renewed weakness in US labor data has rattled risk sentiment.

Via Talk Markets · February 6, 2026

What was noticeable yesterday was that US interest rates did seem to react to some softer labor market data.

Via Talk Markets · February 6, 2026

Indian share markets are trading lower, with the Sensex trading 268 points lower, and the Nifty is trading 101 points lower.

Via Talk Markets · February 6, 2026

German industrial production disappointed at the end of the year, but this is only a temporary halt, not a new downward trend. An industrial upswing is clearly in the making

Via Talk Markets · February 6, 2026

AUD/CAD remains in the positive territory after recovering its daily losses, trading around 0.9520 during the European hours on Friday.

Via Talk Markets · February 6, 2026

In this video, Ira Epstein covers the recent turmoil in the metals and stock markets, highlighting significant declines such as silver reaching $64 an ounce and gold dropping $1,000 from its peak.

Via Talk Markets · February 6, 2026

The Indian Rupee (INR) trades lower against the US Dollar (USD) during afternoon trading hours in India on Friday.

Via Talk Markets · February 6, 2026

The USD/CAD pair trades with mild losses near 1.3685 during the early European session on Friday. The US Dollar softens against the Canadian Dollar amid weaker-than-expected US economic data and a rise in crude oil prices.

Via Talk Markets · February 6, 2026

Market indexes scuba-dived today: went below the surface and stayed there, across the board. Bitcoin, metals and apparently equities are all being painted with the same quivering-hand brush.

Via Talk Markets · February 5, 2026

Alphabet reported fourth-quarter and full year results that exceeded expectations, with revenue climbing 18% and annual sales surpassing $400 billion for the first time.

Via Talk Markets · February 5, 2026

HOOD transformed from an upstart stock-trading app that became famous in the early months of Covid into an S&P 500 giant and a direct competitor to Fidelity and other online brokerages.

Via Talk Markets · February 5, 2026

This analysis compares China’s official GDP against alternative activity indicators, highlighting a growing divergence. While official figures remain steady, satellite data and trade proxies suggest a more significant economic cooling.

Via Talk Markets · February 5, 2026

Strategy (previously known as Microstrategy) reported a net loss of $12.4 billion for the fourth quarter of 2025 after Bitcoin fell from about $120,000 to roughly $89,000 over the period, according to CoinDesk.

Via Talk Markets · February 5, 2026

A new Senate bill aims to prevent data centers from passing their massive energy infrastructure costs onto utility customers. The legislation requires AI and tech firms to fund their own grid upgrades, protecting households from rising rates.

Via Talk Markets · February 5, 2026

With Amazon down a double-digit percentage, it’ll be interesting to see who wins the day tomorrow: will the over-stretched NQ spring back higher temporarily, or will AMZN be bad enough to make the stretched even more over-stretched?

Via Talk Markets · February 5, 2026

In this video, Ira Epstein discusses key developments in the financial markets, highlighting the upcoming US-Iran talks and their potential impact on futures markets.

Via Talk Markets · February 5, 2026

Each week we run a DCF (Discounted Cash Flow) model on a company from our watchlist. This week’s pick: The Walt Disney Company (DIS).

Via Talk Markets · February 5, 2026

This article will analyze Firm Capital Mortgage Investment in greater detail.

Via Talk Markets · February 5, 2026

While gold reclaims $5,000, Bitcoin has cratered below $65,000, acting as a

Via Talk Markets · February 5, 2026

Nacco Industries is trading at a new 3-year high. NC stock is up more than 70% over the past year and has robust technical momentum.

Via Talk Markets · February 5, 2026

Gold price tumbles to around $4,680 during the early Asian session on Friday. The precious metal extends the decline as traders cover losses from equities and adjust positions.

Via Talk Markets · February 5, 2026

It is hard to believe that the S&P 500 is only 2–3% below its all-time high, given the carnage across various parts of the market.

Via Talk Markets · February 5, 2026

The Euro extends its losses on Thursday as the European Central Bank held rates unchanged in an uneventful monetary policy decision.

Via Talk Markets · February 5, 2026

Equities are getting sold, oil and gas are getting clobbered, the metals are being sold hard, and Bitcoin is getting clobbered, too. But bonds are barely reacting.

Via Talk Markets · February 5, 2026

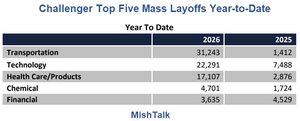

It’s more grim data to start the year.

Via Talk Markets · February 5, 2026

Weak US economic data and risk-off led to a drop in Treasury yields.

Via Talk Markets · February 5, 2026

Every sector closed red today except utilities. That lone green sector tells you exactly where capital is flowing. Money is leaving stocks and moving into bonds, cash, and dividend payers.

Via Talk Markets · February 5, 2026

Tryg A/S provides insurance services. It operates through the following segments: Private, Commercial, Corporate and Other.

Via Talk Markets · February 5, 2026

Long-term Treasury bonds have lost their appeal as yields rise and confidence falters, while gold’s bull market continues. It claims this reflects weaker faith in U.S. credit and growing demand for gold as a safe haven.

Via Talk Markets · February 5, 2026

The 24% YoY increase in AWS revenue not only smashed estimates, but was the highest in three years: remarkable growth for a business that keeps growing and has a more difficult base effect to

Via Talk Markets · February 5, 2026

The rich have been spending so amply that they've kept the averages for retail spending -- which drives the majority of our GDP -- in

Via Talk Markets · February 5, 2026

The Dow lost nearly 600 points on Thursday, while the Nasdaq suffered a triple-digit drop as well, marking its third-straight loss alongside the S&P 500 as investors continued to rotate out of tech.

Via Talk Markets · February 5, 2026

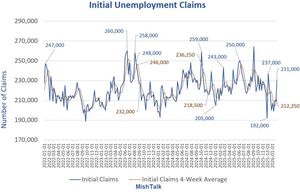

Initial claims unexpectedly spiked to 231,000.

Via Talk Markets · February 5, 2026

Crude OIl markets are easing into the low side on Thursday.

Via Talk Markets · February 5, 2026

The 25Q4 Y/Y blended earnings growth estimate is 69.9%. If the energy sector is excluded, the growth rate for the index is 79.8%.

Via Talk Markets · February 5, 2026

While software is in the red since Trump's tariff turmoil, the two groups where stocks are up the most are in the hardware space.

Via Talk Markets · February 5, 2026

Rice was higher again yesterday and trends are up. Traders anticipate less production this year in the U.S. and around the world due to low prices.

Via Talk Markets · February 5, 2026

People using tools like Claude Code have been genuinely surprised by how different the experience feels.

Via Talk Markets · February 5, 2026

Gold slides to $4,880 as broad US Dollar strength and profit-taking weigh on precious metals.

Via Talk Markets · February 5, 2026

The next support is just below $60k, but bitcoin could decline briefly all the way to $50k.

Via Talk Markets · February 5, 2026