News

In a transformative move that blurs the lines between decentralized finance and Wall Street, Coinbase Global, Inc. (NASDAQ: COIN) has officially completed the rollout of its new "Everything Exchange" ecosystem. As of January 2026, the platform now offers commission-free U.S.-listed stock trading and fully integrated prediction markets to

Via MarketMinute · January 22, 2026

In a dramatic reshaping of market leadership, the Russell 2000 Index (INDEXRUSSELL: RUT) has officially outperformed the S&P 500 (INDEXSP: .INX) for 13 consecutive trading sessions as of January 21, 2026. This extraordinary streak, which matches a record last seen in the volatile summer of 2008, signals a profound

Via MarketMinute · January 22, 2026

The world's largest Bitcoin hoarder could have a bright future.

Via The Motley Fool · January 22, 2026

The 21Shares Dogecoin ETF (NASDAQ:TDOG) on Wednesday launched on the Nasdaq as the first spot Dogecoin

Via Benzinga · January 22, 2026

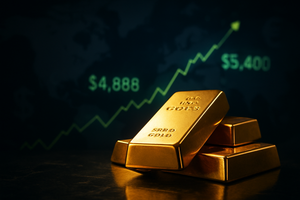

Both metals have already hit new all-time highs this year.

Via The Motley Fool · January 22, 2026

Dogecoin (CRYPTO: DOGE) has taken another step into the financial mainstream with the launch of a spot ETF backed by the

Via Benzinga · January 22, 2026

The Charles Schwab Corporation (NYSE:SCHW) reported its fourth-quarter and full-year 2025 earnings on January 21, 2026, revealing a complex portrait of the modern retail investor. While the brokerage giant achieved a staggering record of $11.90 trillion in total client assets, the market's response was notably muted. The core

Via MarketMinute · January 22, 2026

Tradr launches four inverse ETFs tied to Lucid, Iren, Nebius and Applied Digital, as Trump tariff talks fuel volatility in the EV and AI stocks.

Via Benzinga · January 22, 2026

The pillars of the global financial system trembled this week as the U.S. Supreme Court (SCOTUS) took up the case of Trump v. Cook, a high-stakes legal battle that could redefine the executive branch’s authority over the Federal Reserve. At the heart of the dispute is President Donald

Via MarketMinute · January 22, 2026

As the Federal Reserve prepares for its first policy meeting of 2026 on January 28, a quiet revolution is taking place on the trading floors of Manhattan and Chicago. While traditional bond traders scramble to interpret yield curve shifts, a growing cohort of institutional and retail investors is turning to Kalshi to buy direct protection [...]

Via PredictStreet · January 22, 2026

The tech sector is teetering in 2026, leaving many investors to wonder how they should play tech ETFs like XLK this year. Here's what to know.

Via Barchart.com · January 22, 2026

The U.S. natural gas market witnessed a staggering display of volatility this week as an unforgiving Arctic blast descended upon the Lower 48, sending demand to record highs and prices into the stratosphere. On Tuesday, January 20, 2026, February Nymex natural gas futures (NGG26) posted a historic single-day gain

Via MarketMinute · January 22, 2026

The global gold market reached a historic fever pitch this week as spot prices shattered all previous records, testing the $4,888 per ounce level during intraday trading on Wednesday, January 21, 2026. The surge marks a definitive escalation in what analysts are calling a "structural bull market," driven by

Via MarketMinute · January 22, 2026

Begin your search with your specific goals in mind, and then ask yourself which fund is best-suited to meet them.

Via The Motley Fool · January 22, 2026

The silver market has entered a historic "parabolic" phase this January, with spot prices hitting a record high of $95.75 per ounce as of January 20, 2026. This rapid ascent follows a decisive technical breakout past the $85.80 resistance level earlier this month, a move that has triggered

Via MarketMinute · January 22, 2026

As of January 22, 2026, the financial landscape is witnessing a historic shift. After nearly two years of mega-cap technology dominance driven by the artificial intelligence boom, the "Great Rotation" has finally arrived. Capital is flowing out of the overcrowded Silicon Valley giants and into the domestic-focused engines of the

Via MarketMinute · January 22, 2026

DAVOS, Switzerland — In a move that has sent shockwaves of relief through global financial markets, President Donald Trump used his keynote address at the World Economic Forum in Davos on January 21, 2026, to announce a "framework deal" for the strategic integration of Greenland into a joint U.S.-NATO

Via MarketMinute · January 22, 2026

As of January 22, 2026, MicroStrategy Incorporated (NASDAQ: MSTR)—which recently rebranded its corporate identity to Strategy Inc.—stands as one of the most polarizing and fascinating case studies in modern finance. Once a traditional enterprise software firm, the company has transformed itself into the world’s first "Bitcoin Treasury Company." Today, MicroStrategy is less of a technology [...]

Via Finterra · January 22, 2026

As of January 22, 2026, First Solar, Inc. (NASDAQ: FSLR) stands as the undisputed titan of the American renewable energy sector. While the broader solar industry has often been characterized by extreme cyclicality and intense price competition from overseas, First Solar has carved out a unique, high-margin fortress. Today, the company is in the spotlight [...]

Via Finterra · January 22, 2026

Host Hotels & Resorts is all set to announce its fiscal fourth-quarter earnings next month, and analysts project a single-digit FFO growth.

Via Barchart.com · January 22, 2026

Ark Invest is beating the market again in 2026, and the iconic growth investor wants to keep it that way.

Via The Motley Fool · January 22, 2026

In the past 12 months, this popular ETF has produced a total return of 17%.

Via The Motley Fool · January 22, 2026

Campbell is set to release its second-quarter results soon, and analysts are expecting a double-digit decrease in earnings.

Via Barchart.com · January 22, 2026

Garmin is all set to unveil its fiscal fourth-quarter earnings next month, and analysts project a marginal drop in earnings

Via Barchart.com · January 22, 2026

American Water Works is ready to announce its fiscal fourth-quarter earnings next month, and analysts project a single-digit earnings growth.

Via Barchart.com · January 22, 2026