Latest News

Shares of digital media conglomerate IAC (NASDAQGS:IAC) fell 3.1% in the afternoon session after Oppenheimer downgraded the company's stock to 'Perform' from 'Outperform,' citing concerns about its valuation.

Via StockStory · December 15, 2025

Shares of electric vehicle manufacturer Rivian (NASDAQ:RIVN) jumped 2.8% in the afternoon session after analysts reacted positively to its inaugural "Autonomy & AI Day," where it revealed plans for a custom-designed processing chip and a new subscription service for its self-driving features.

Via StockStory · December 15, 2025

Shares of telecommunications infrastructure company Lumen Technologies (NYSE:LUMN) fell 4.2% in the afternoon session after a broad sell-off in the technology sector and continued concerns about the company's financial health.

Via StockStory · December 15, 2025

Via Benzinga · December 15, 2025

Via Benzinga · December 15, 2025

Via Benzinga · December 15, 2025

Shares of EV charging solutions provider ChargePoint Holdings (NYSE:CHPT)

fell 4.6% in the afternoon session after the company filed for the sale of 4.73 million shares of common stock, creating concern among investors. The move to sell additional shares, which often signals a company's need to raise money, can lead to the dilution of existing shares. This development came amid a challenging backdrop for the electric vehicle (EV) industry.

Via StockStory · December 15, 2025

Shares of electric vehicle pioneer Tesla (NASDAQ:TSLA) jumped 3.8% in the afternoon session after Wedbush analyst Dan Ives reiterated his $600 price target, declaring 2026 a pivotal "monster year" for the EV giant.

Via StockStory · December 15, 2025

Shares of enterprise workflow automation company ServiceNow (NYSE:NOW) fell 10.8% in the afternoon session after reports revealed the company was in talks to acquire cybersecurity startup Armis for $7 billion.

Via StockStory · December 15, 2025

Via Benzinga · December 15, 2025

Shares of boutique fitness studio franchisor Xponential Fitness (NYSE:XPOF)

fell 5.2% in the afternoon session after analyst sentiment turned more cautious following recent price target reductions from financial firms.

Via StockStory · December 15, 2025

Shares of materials and photonics company Coherent (NYSE:COHR) jumped 1.1% in the afternoon session after JPMorgan raised its price target on the stock to $215, prompting investor optimism. The bank cited significant growth potential for the company. The move also followed Coherent's launch of a new 300mm silicon carbide platform. This technology was designed to meet the increasing need for better cooling efficiency in artificial intelligence (AI) data centers. Additionally, the new platform bolstered technologies used in other advanced electronics, including augmented and virtual reality (AR/VR) devices.

Via StockStory · December 15, 2025

Shares of scientific consulting firm Exponent (NASDAQ:EXPO) jumped in the afternoon session after UBS raised its price target on the company's stock to $81 from $76. The financial services firm kept a "Neutral" rating on the stock.

Via StockStory · December 15, 2025

March ICE NY cocoa (CCH26 ) today is down -429 (-6.83%), and March ICE London cocoa #7 (CAH26 ) closed down -321 (-7.05%). Cocoa prices are sinking today as rains in West Africa and a delay in the seasonal Harmattan winds have been beneficial to coco...

Via Barchart.com · December 15, 2025

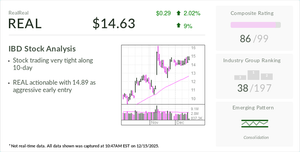

The RealReal stock is gaining after a bullish analyst initiation report, adding to momentum for the resale-focused online platform.

Via Investor's Business Daily · December 15, 2025

Tesla shares were up nearly 4% in Monday’s midday trade after CEO Elon Musk stated in a post on Sunday that the EV giant had begun fully autonomous testing of Robotaxis in Austin.

Via Stocktwits · December 15, 2025

The billionaire investor recently addressed why his holding company unloaded its $5.8 billion stake in Nvidia.

Via The Motley Fool · December 15, 2025

Via Benzinga · December 15, 2025

Via Benzinga · December 15, 2025

Stay informed about the performance of the S&P500 index in the middle of the day on Monday. Uncover the top gainers and losers in today's session for valuable insights.

Via Chartmill · December 15, 2025

Wall Street traded little changed Monday after last Friday’s tech-led sell-off failed to trigger meaningful dip-buying interest. By midday trading in New York, major indexes hovered near flat levels as investors stayed cautious ahead of a dense macro calendar this week.

Via Benzinga · December 15, 2025

March arabica coffee (KCH26 ) today is down -8.65 (-2.34%), and January ICE robusta coffee (RMF26 ) is down -88 (-2.13%). Coffee prices extended last Friday's plunge today, with arabica falling to a 3-week low and robusta sliding to a 4-month low. A...

Via Barchart.com · December 15, 2025

Pfizer to provide full-year 2026 financial guidance on Tuesday. BofA analyst expects flat growth, reiterates Neutral rating.

Via Benzinga · December 15, 2025

Via Benzinga · December 15, 2025

Via Benzinga · December 15, 2025

Curious to know what's happening on the US markets in the middle of the day on Monday? Join us as we explore the top gainers and losers in today's session.

Via Chartmill · December 15, 2025

Via MarketBeat · December 15, 2025

Via Benzinga · December 15, 2025

Bloom Energy shares were hit hard last week, but the stock is still up more than 300% this year.

Via The Motley Fool · December 15, 2025

The advertising market is incredibly strong.

Via The Motley Fool · December 15, 2025

January WTI crude oil (CLF26 ) today is down -0.84 (-1.46%), and January RBOB gasoline (RBF26 ) is down -0.0234 (-1.34%). Crude oil and gasoline prices are under pressure today, with crude oil falling to a 1.75-month low and gasoline posting a 4.75-y...

Via Barchart.com · December 15, 2025

Marvell’s recent selloff reflects market fears over potential loss of hyperscaler orders, but management and some analysts push back on those concerns, raising the key question of how investors should position in MRVL stock now.

Via Barchart.com · December 15, 2025

Kevin Hassett’s once-clear path to the Fed’s top job has become uncertain after pushback from Trump insiders revived Kevin Warsh’s candidacy.

Via Stocktwits · December 15, 2025

Gilead said its two-drug bictegravir-lenacapavir tablet was non-inferior to Biktarvy in the Phase 3 ARTISTRY-2 HIV trial.

Via Benzinga · December 15, 2025

You won't go wrong owning either of these top AI stocks.

Via The Motley Fool · December 15, 2025

As of December 15, 2025, Metals Exploration Plc (LON: MTL) is a London-listed gold producer that has captured investor attention due to its operational activities and recent project updates. The company is primarily focused on the identification, acquisition, exploration, and development of mining and processing projects for precious and base metals, with a significant operational [...]

Via PredictStreet · December 15, 2025

Immunome stock surges after positive results from Phase 3 trial for desmoid tumors, meeting all key endpoints.

Via Benzinga · December 15, 2025

Visa Inc.

Via Benzinga · December 15, 2025

Alphabet's SpaceX stake may boost its earnings again, putting Alphabet-heavy ETFs in focus as private-market gains ripple into public ETF returns.

Via Benzinga · December 15, 2025

The Patrick Mahomes injury and Kansas City Chiefs missing the NFL Playoffs in the 2025 season could be bad news for Amazon stock. Here's why.

Via Benzinga · December 15, 2025

NVIDIA’s relationship with SchedMD goes back a decade, and the company said it will continue to support the Slurm open-source software.

Via Stocktwits · December 15, 2025

Canopy Growth Corporation (CGC), listed on the NASDAQ exchange, is a prominent Canadian cannabis company engaged in the production, distribution, and sale of cannabis, hemp, and related products for both medical and recreational markets. Headquartered in Smiths Falls, Ontario, Canada, Canopy Growth offers a diverse portfolio including dried flower, pre-rolls, extracts, concentrates, beverages, vapes, and [...]

Via PredictStreet · December 15, 2025

Via Benzinga · December 15, 2025

Via Benzinga · December 15, 2025

Luminar shares are under heavy pressure Monday after the company announced that it initiated voluntary Chapter 11 proceedings.

Via Benzinga · December 15, 2025

Bank of America sees Eli Lilly's obesity drug growth underestimated, forecasting $3 billion Orfoglipron revenue by 2026 as new therapies expand global market leadership.

Via Benzinga · December 15, 2025

Small Caps Outperforming Please click here for an enlarged chart of small cap iShares Russell 2000 ETF

Via Benzinga · December 15, 2025

The change that most of the industry has been hoping to avoid is finally being forced upon it.

Via The Motley Fool · December 15, 2025

Apple's iPhone 17 delivery lead times are rising across the US, China, and Europe, signaling resilient demand and supporting expectations for strong iPhone revenue growth into early 2026.

Via Benzinga · December 15, 2025