MasterCard (MA)

548.74

-3.15 (-0.57%)

NYSE · Last Trade: Feb 8th, 12:20 PM EST

Detailed Quote

| Previous Close | 551.89 |

|---|---|

| Open | 553.07 |

| Bid | 548.05 |

| Ask | 548.60 |

| Day's Range | 539.80 - 556.79 |

| 52 Week Range | 465.59 - 601.77 |

| Volume | 3,779,748 |

| Market Cap | 496.61B |

| PE Ratio (TTM) | 35.09 |

| EPS (TTM) | 15.6 |

| Dividend & Yield | 3.480 (0.63%) |

| 1 Month Average Volume | 4,549,279 |

Chart

About MasterCard (MA)

Mastercard is a global technology company that facilitates digital payments by connecting consumers, financial institutions, and merchants through its secure transaction processing networks. The company provides a range of payment solutions, including credit and debit card services, contactless payments, and mobile payment applications. Mastercard's platform aims to enhance the payment experience by offering innovative technologies and insights that help businesses and consumers make transactions easier, safer, and more efficient. Through partnerships with various stakeholders in the financial ecosystem, Mastercard continuously works to promote financial inclusion and empower people to transact in a digital world. Read More

News & Press Releases

At more than $250 billion in market cap, the stablecoin industry is just too big to ignore any longer.

Via The Motley Fool · February 8, 2026

It can be important for investors to have a solid foundation in their portfolios.

Via The Motley Fool · February 8, 2026

American Express stock has tripled in five years. A recent premium card relaunch suggests the good times aren't over yet.

Via The Motley Fool · February 7, 2026

The leader in electronic payments is struggling to get back to its pandemic highs.

Via The Motley Fool · February 7, 2026

Could Buying American Express (AXP) Today Set You Up for Life?fool.com

Via The Motley Fool · February 4, 2026

Charge1 strengthens its payment gateway with network-level card updates for more reliable recurring billing

Via PRUnderground · February 7, 2026

WASHINGTON, D.C. — In a week that has sent tremors through the global financial architecture, Treasury Secretary Scott Bessent appeared before the Senate Banking Committee on February 5, 2026, delivering testimony that many economists believe signals a fundamental shift in the relationship between the White House and the Federal Reserve.

Via MarketMinute · February 6, 2026

The powerhouse financial stock hasn't looked all that mighty lately.

Via The Motley Fool · February 5, 2026

The Bitwise Crypto Industry Innovators ETF is flat year to date as Bitcoin has a slow start to the year.

Via The Motley Fool · February 5, 2026

Mastercard's fourth quarter results aligned with Wall Street’s revenue expectations while delivering a notable non-GAAP earnings outperformance. Management credited the company’s diversified global footprint and ongoing expansion of value-added services as the key drivers behind the quarter’s growth. CEO Michael Miebach highlighted new issuing deals across the U.S., Europe, and emerging markets, citing strengthened partnerships, especially with Capital One and Scotiabank. He also pointed to strong demand for digital security and analytics offerings, as well as continued volume growth in cross-border payments and commercial card usage.

Via StockStory · February 5, 2026

Corpay (CPAY) Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 4, 2026

Mastercard has underperformed the broader market over the past year, but analysts are highly optimistic about the stock’s prospects.

Via Barchart.com · February 4, 2026

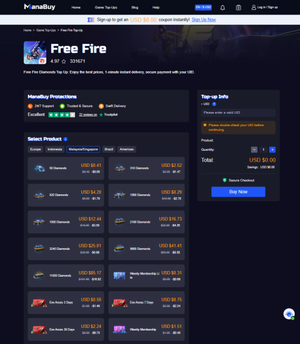

ManaBuy’s 2026 platform update enhances the Free Fire top-up experience with a faster purchase flow, clearer order tracking, improved local-currency checkout in select markets, quicker delivery after payment verification, and more competitive deals—while keeping transactions safer by fulfilling via the player’s UID without requiring passwords.

Via Binary News Network · February 4, 2026

Credit cards have been in the news a lot lately.

Via The Motley Fool · February 3, 2026

On January 29, 2026, Mastercard Inc. (NYSE:MA) reported fourth-quarter and full-year 2025 financial results that comfortably surpassed Wall Street expectations, signaling that the global consumer remains remarkably resilient despite years of inflationary pressure. The company posted net revenue of $8.8 billion for the quarter, an 18% increase over

Via MarketMinute · February 2, 2026

The global payments landscape showed remarkable durability in the face of shifting macroeconomic winds as Visa (NYSE: V) reported its fiscal first-quarter 2026 earnings. Surpassing Wall Street expectations, the payment giant demonstrated that even as service-sector inflation remains "sticky" and geopolitical trade tensions introduce new variables like tariffs, the consumer's

Via MarketMinute · February 2, 2026

As of early February 2026, the resilience of the U.S. consumer has once again defied the skeptics. Despite years of fluctuating interest rates and persistent concerns over a cooling labor market, the latest fourth-quarter 2025 earnings from the world's largest payment processors have provided a definitive "all-clear" on the

Via MarketMinute · February 2, 2026

NEW YORK — In a tale of two realities, the world’s leading payment giants, Visa Inc. (NYSE: V) and Mastercard Inc. (NYSE: MA), reported robust earnings for the final quarter of 2025, revealing a U.S. consumer that remains resilient despite mounting economic and political headwinds. However, the financial triumph

Via MarketMinute · February 2, 2026

Both companies just reported impressive revenue and earnings gains.

Via The Motley Fool · February 2, 2026

Both stocks are speculative, but one may stand out as the less risky choice.

Via The Motley Fool · February 2, 2026

Budapest, Hungary, 2nd February 2026, ZEX PR WIRE— WeChange, a noncustodial global crypto onramp, announces the official launch of its noncustodial fiat-to-crypto on-ramp, designed to simplify how everyday users buy and sell digital assets while maintaining full control of their funds. The platform goes live globally on January 30, supporting bank transfer methods

Via Zexprwire · February 2, 2026

It isn't the highest-paying dividend ETF, but it's worth a closer look.

Via The Motley Fool · February 1, 2026

You can take a set-it-and-forget-it approach with these two industry leaders.

Via The Motley Fool · February 1, 2026

They are great long-term options.

Via The Motley Fool · February 1, 2026

The sell-off in Mastercard and Visa is a tremendous buying opportunity for long-term investors.

Via The Motley Fool · January 31, 2026