Microsoft (MSFT)

400.78

+7.11 (1.81%)

NASDAQ · Last Trade: Feb 7th, 2:27 PM EST

Detailed Quote

| Previous Close | 393.67 |

|---|---|

| Open | 399.17 |

| Bid | 403.00 |

| Ask | 403.30 |

| Day's Range | 392.92 - 401.79 |

| 52 Week Range | 344.79 - 555.45 |

| Volume | 53,515,311 |

| Market Cap | 3.02T |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 3.640 (0.91%) |

| 1 Month Average Volume | 39,732,459 |

Chart

About Microsoft (MSFT)

Microsoft is a leading global technology company known for its software products, services, and hardware devices. The company is best recognized for its Windows operating systems and the Microsoft Office suite, which facilitates productivity and collaboration for users worldwide. In addition to software, Microsoft also offers cloud computing services through its Azure platform, enabling businesses to leverage scalable and flexible computing resources. The company is actively involved in various sectors, including gaming with its Xbox platform, artificial intelligence, and cybersecurity, continually innovating and expanding its product offerings to meet the diverse needs of consumers and enterprises. Read More

News & Press Releases

Explore how differences in cost, diversification, and holdings shape the appeal of these two popular U.S. equity ETFs for investors.

Via The Motley Fool · February 7, 2026

These companies have highly visible growth profiles for the next several years.

Via The Motley Fool · February 7, 2026

Explore how QLD’s tech-heavy approach stacks up against SSO’s broader diversification for leveraged ETF investors.

Via The Motley Fool · February 7, 2026

Explore how sector focus and dividend strategy set these two leading ETFs apart for investors seeking income or growth.

Via The Motley Fool · February 7, 2026

There are several great investment opportunities in the AI sector.

Via The Motley Fool · February 7, 2026

Tech stocks are in turmoil, but Apple investors are staying calm.

Via The Motley Fool · February 7, 2026

Explore how differences in sector focus, diversification, and volatility shape the risk and reward profiles of these two popular ETFs.

Via The Motley Fool · February 7, 2026

Microsoft and Meta Platforms are two artificial intelligence (AI) stocks to buy and hold for the long term.

Via The Motley Fool · February 7, 2026

Artificial intelligence is a fancy computer program that has to live somewhere.

Via The Motley Fool · February 7, 2026

These stocks pay dividends, have promising growth prospects, and are all-around safer investments.

Via The Motley Fool · February 7, 2026

Tom Lee says the S&P 500 (a benchmark for the U.S. stock market) can hit 15,000 by 2030.

Via The Motley Fool · February 7, 2026

UiPath has flown under the media's radar despite some heavy Wall Street investment late last year, is it worth a look?

Via The Motley Fool · February 7, 2026

SemiAnalysis President Doug O'Laughlin criticized Microsoft's AI competitiveness while praising Amazon Web Services' scale and infrastructure execution.

Via Benzinga · February 7, 2026

Investing doesn't have to be complicated.

Via The Motley Fool · February 7, 2026

Quantum computing is an exciting opportunity, but the technology is young, and the pure plays are still highly risky investments. Fortunately, you don't need to swing for the fences with your stock picks to win.

Via The Motley Fool · February 6, 2026

There's growing debate over a possible AI bubble.

Via The Motley Fool · February 6, 2026

Iren's pivot from Bitcoin mining to Microsoft-backed AI infrastructure is redefining its long-term narrative, today, Feb. 6, 2026.

Via The Motley Fool · February 6, 2026

NuScale Power's stock had some serious momentum behind it.

Via The Motley Fool · February 6, 2026

IonQ investors were happy to see the quantum company's stock recover along with the market.

Via The Motley Fool · February 6, 2026

The quantum computing stock is finally seeing green.

Via The Motley Fool · February 6, 2026

In a move that has sent shockwaves through Silicon Valley and Wall Street alike, Alphabet Inc. (NASDAQ: GOOGL) has unveiled a staggering capital expenditure outlook for 2026, signaling its intent to lead the next era of computing at any cost. Following its Q4 2025 earnings report, the tech giant announced

Via MarketMinute · February 6, 2026

The global financial landscape was upended this week following the announcement that Kevin Warsh, a former Federal Reserve Governor known for his skeptical stance on unconventional monetary policy, has been nominated to succeed Jerome Powell as the next Chair of the Federal Reserve. The news, which broke on the morning

Via MarketMinute · February 6, 2026

SEATTLE — Shares of Amazon.com, Inc. (NASDAQ:AMZN) plummeted more than 5% in early trading on Friday, February 6, 2026, following a fourth-quarter earnings report that showcased record-breaking revenue but also unveiled a staggering $200 billion capital expenditure plan for the coming year. While the tech giant beat analyst expectations

Via MarketMinute · February 6, 2026

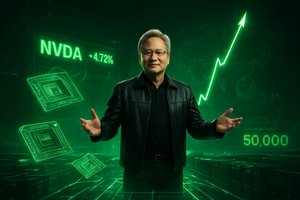

In a historic session for Wall Street, shares of Nvidia (NASDAQ:NVDA) surged more than 8% on Friday, February 6, 2026, breathing new life into the global technology trade. The rally was ignited by a high-stakes television appearance by CEO Jensen Huang, who declared that the demand for artificial intelligence

Via MarketMinute · February 6, 2026

In a historic display of market resilience and technological optimism, the Dow Jones Industrial Average closed above the 50,000-point milestone for the first time in history on Friday, February 6, 2026. The blue-chip index surged by a staggering 1,200 points during the session, ending the day at 50,

Via MarketMinute · February 6, 2026