Shareholders of Enphase would probably like to forget the past six months even happened. The stock dropped 38.5% and now trades at $38.31. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Enphase, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Enphase Not Exciting?

Even though the stock has become cheaper, we're swiping left on Enphase for now. Here are three reasons you should be careful with ENPH and a stock we'd rather own.

1. Demand Slips as Sales Volumes Slide

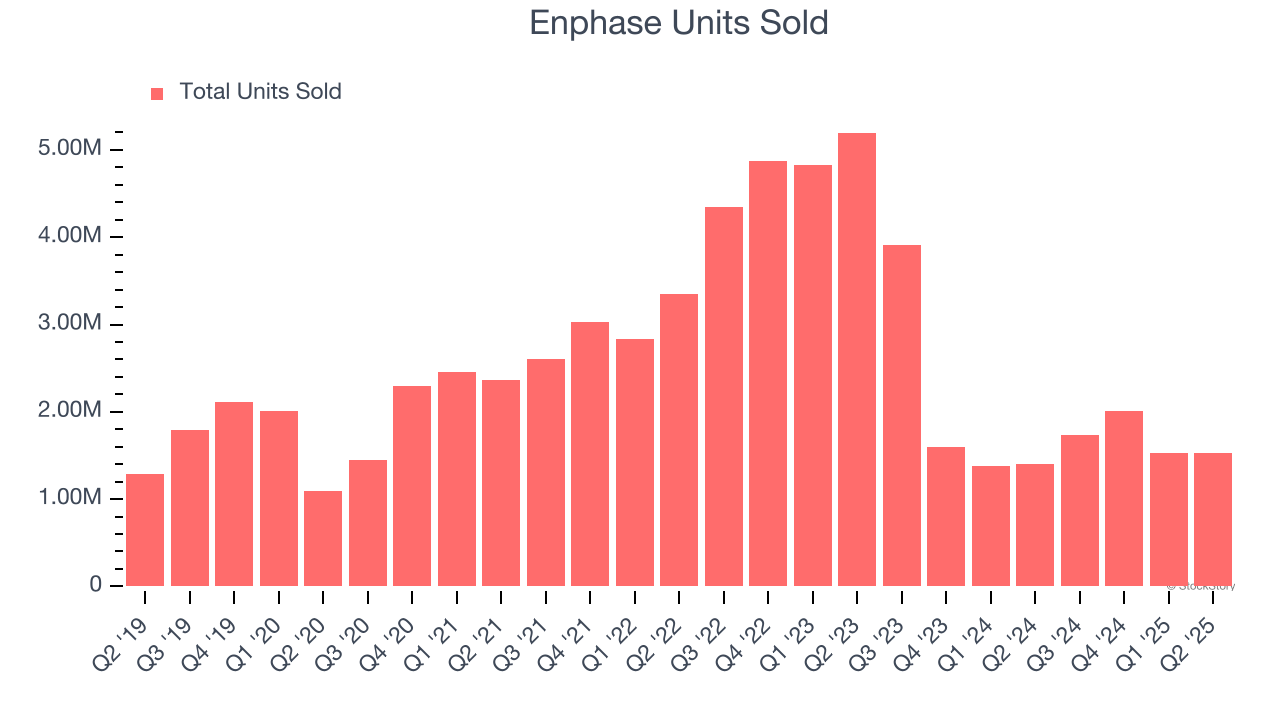

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Renewable Energy company because there’s a ceiling to what customers will pay.

Enphase’s units sold came in at 1.53 million in the latest quarter, and they averaged 28.9% year-on-year declines over the last two years. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Enphase might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. Shrinking Operating Margin

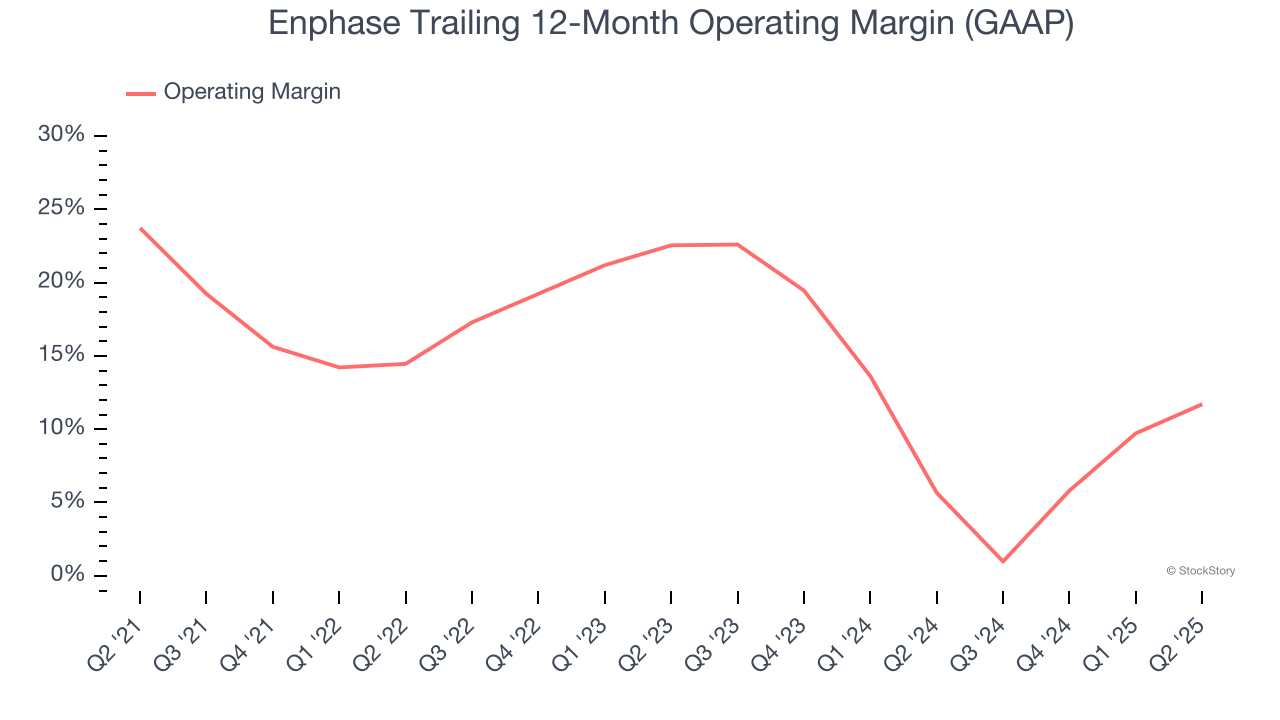

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Looking at the trend in its profitability, Enphase’s operating margin decreased by 12 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 11.7%.

3. EPS Took a Dip Over the Last Two Years

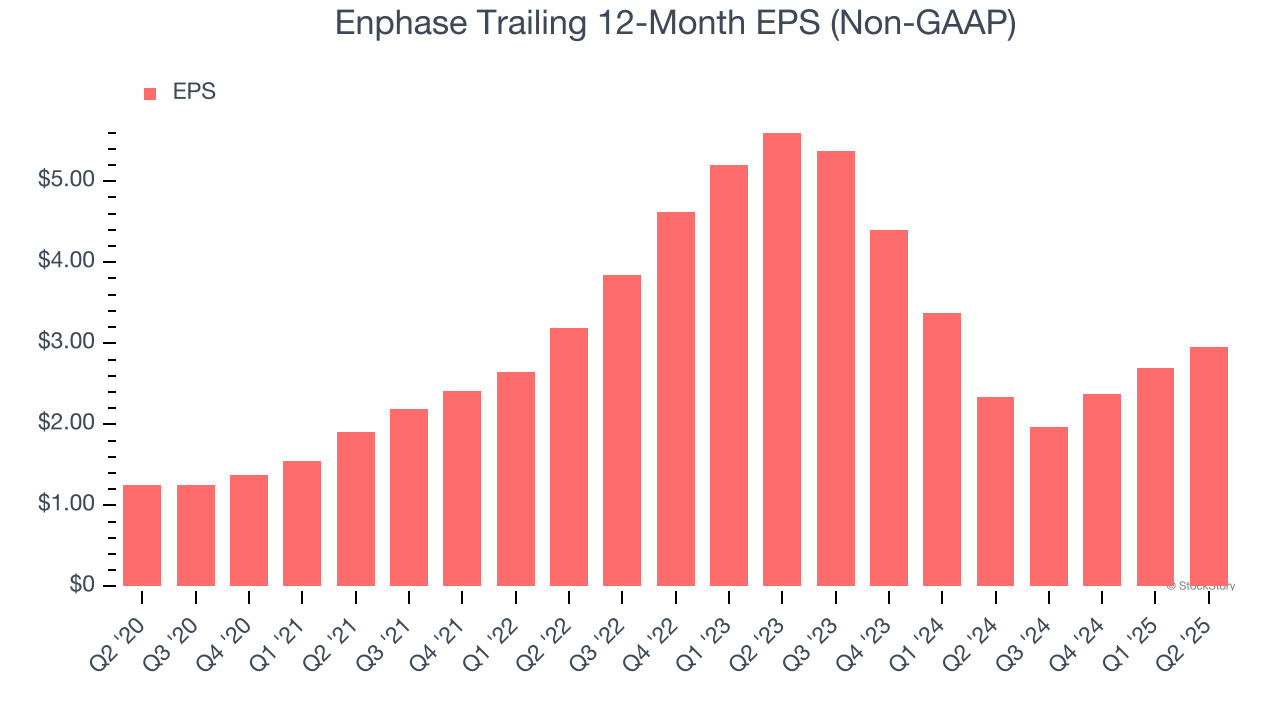

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Enphase, its EPS and revenue declined by 27.3% and 27.2% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Enphase’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

Enphase isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 15.4× forward P/E (or $38.31 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. We’d recommend looking at the most dominant software business in the world.

Stocks We Like More Than Enphase

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.