Home services online marketplace ANGI (NASDAQ: ANGI) reported Q2 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 11.7% year on year to $278.2 million. Its GAAP profit of $0.23 per share was 12.4% below analysts’ consensus estimates.

Is now the time to buy Angi? Find out by accessing our full research report, it’s free.

Angi (ANGI) Q2 CY2025 Highlights:

- Revenue: $278.2 million vs analyst estimates of $261.2 million (11.7% year-on-year decline, 6.5% beat)

- EPS (GAAP): $0.23 vs analyst expectations of $0.26 (12.4% miss)

- Adjusted EBITDA: $33 million vs analyst estimates of $31.45 million (11.9% margin, 4.9% beat)

- Operating Margin: 6.4%, up from 2.9% in the same quarter last year

- Free Cash Flow was $44.89 million, up from -$15.69 million in the previous quarter

- Service Requests: 4.56 million, down 377,000 year on year

- Market Capitalization: $781.7 million

Company Overview

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

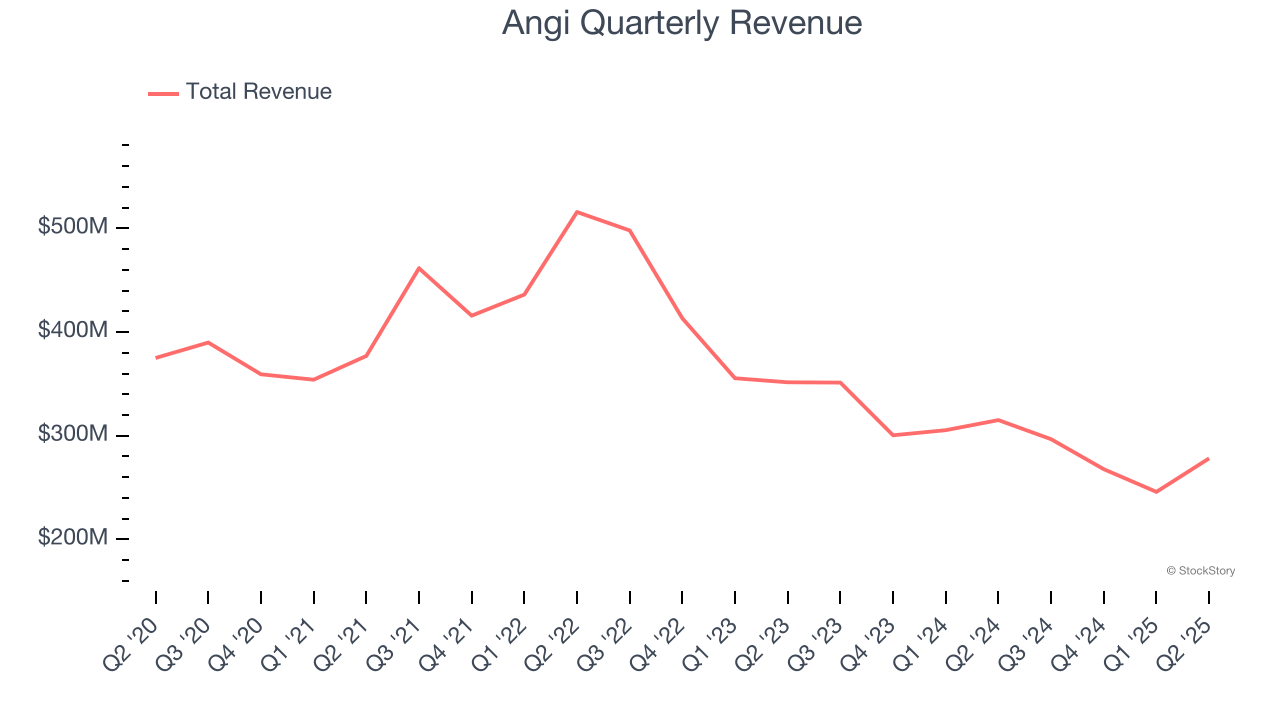

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Angi struggled to consistently generate demand over the last three years as its sales dropped at a 15.9% annual rate. This wasn’t a great result and suggests it’s a lower quality business.

This quarter, Angi’s revenue fell by 11.7% year on year to $278.2 million but beat Wall Street’s estimates by 6.5%.

Looking ahead, sell-side analysts expect revenue to decline by 5.7% over the next 12 months. it’s hard to get excited about a company that is struggling with demand.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Service Requests

Request Growth

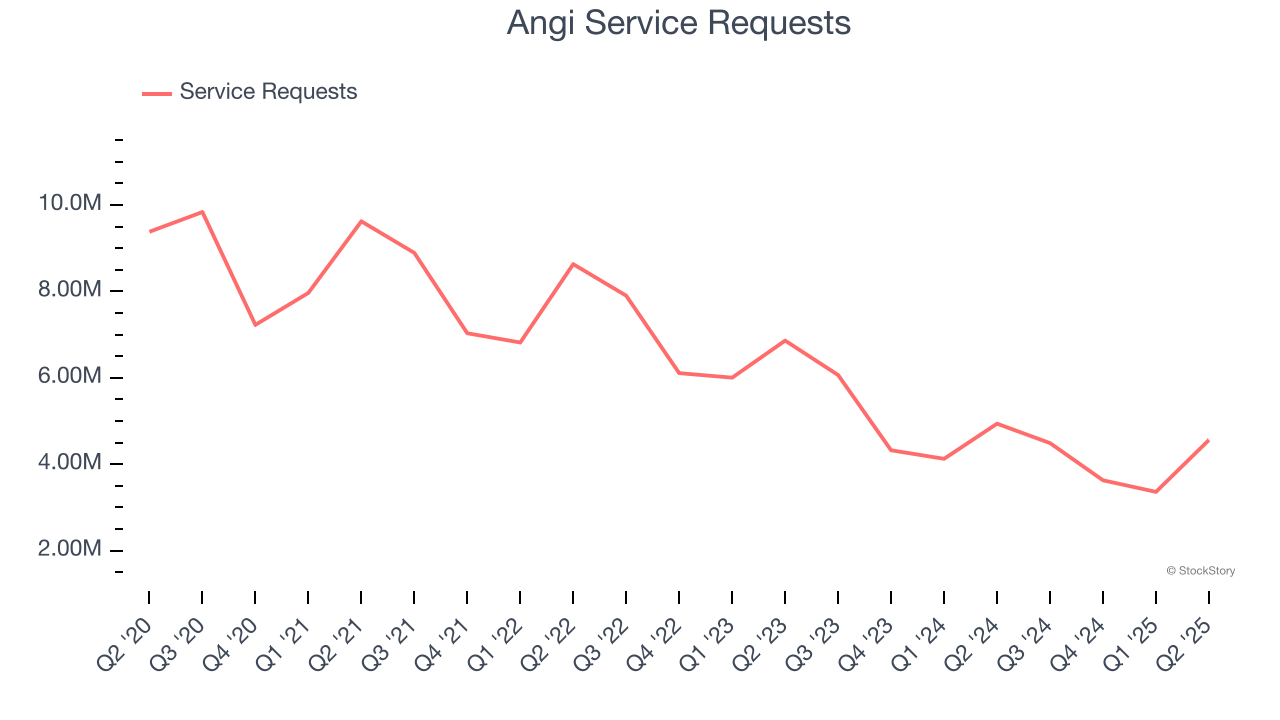

As a gig economy marketplace, Angi generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Angi struggled with new customer acquisition over the last two years as its service requests have declined by 22.5% annually to 4.56 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Angi wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q2, Angi’s service requests once again decreased by 377,000, a 7.6% drop since last year. On the bright side, the quarterly print was higher than its two-year result and suggests its new initiatives are accelerating request growth.

Revenue Per Request

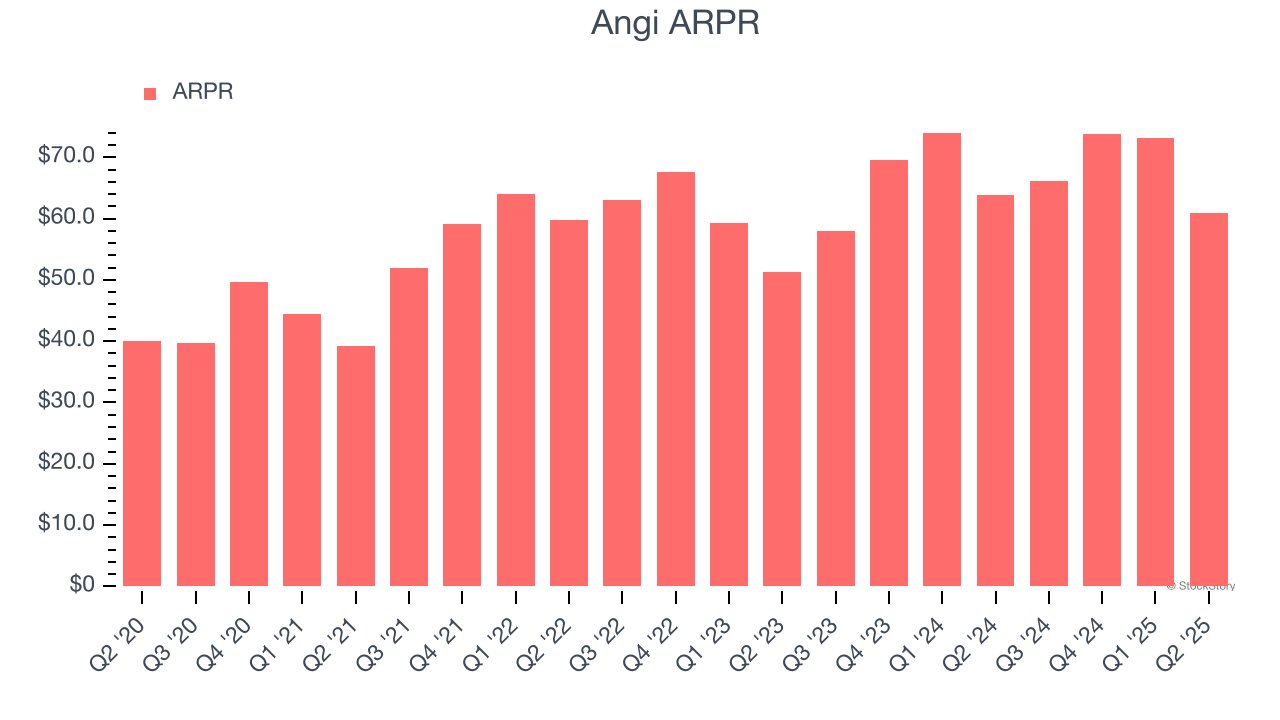

Average revenue per request (ARPR) is a critical metric to track because it measures how much the company earns in transaction fees from each request. This number also informs us about Angi’s take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Angi’s ARPR growth has been impressive over the last two years, averaging 7.4%. Although its service requests shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing requests.

This quarter, Angi’s ARPR clocked in at $60.99. It declined 4.4% year on year but outperformed the change in its service requests.

Key Takeaways from Angi’s Q2 Results

We were impressed by how significantly Angi blew past analysts’ number of service requests expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its number of requests declined. Zooming out, we think this quarter featured some important positives. The stock traded up 12% to $17.54 immediately after reporting.

Angi may have had a good quarter, but does that mean you should invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.