Shareholders of Kontoor Brands would probably like to forget the past six months even happened. The stock dropped 26.6% and now trades at $57.84. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Kontoor Brands, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why KTB doesn't excite us and a stock we'd rather own.

Why Is Kontoor Brands Not Exciting?

Founded in 2019 after separating from VF Corporation, Kontoor Brands (NYSE:KTB) is a clothing company known for its high-quality denim products.

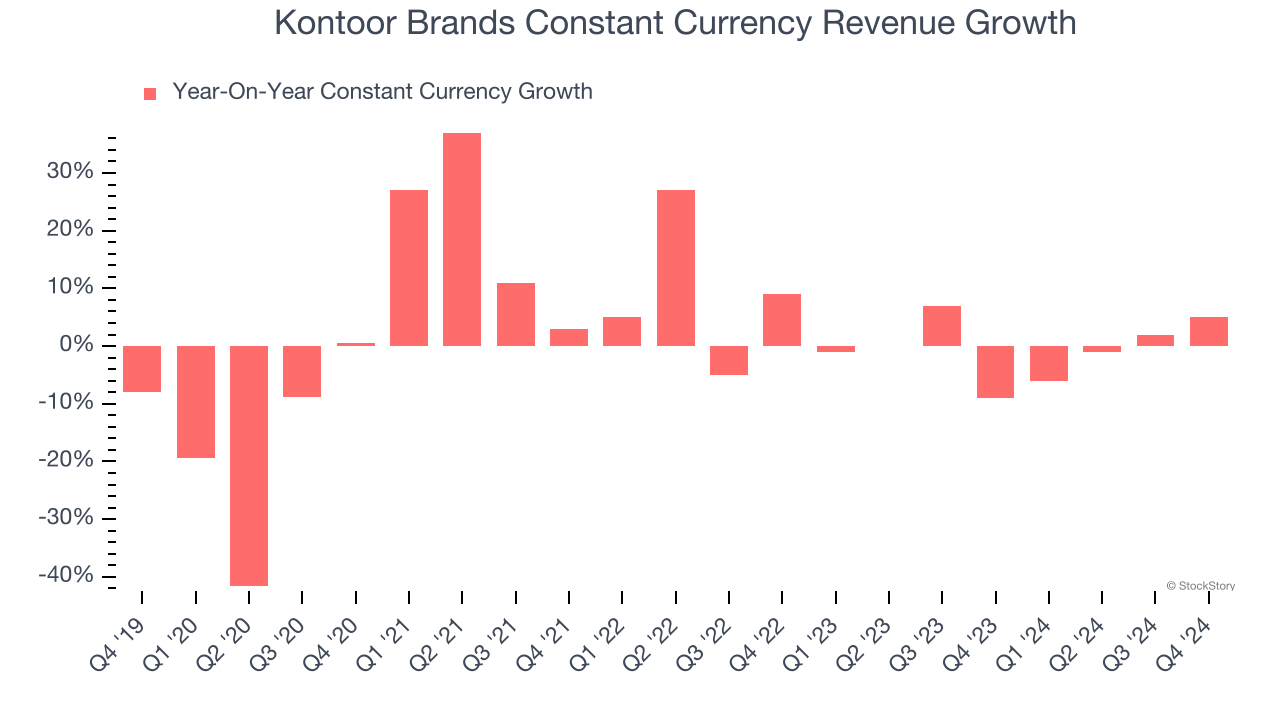

1. Constant Currency Revenue Hits a Standstill

Investors interested in Apparel and Accessories companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of Kontoor Brands’s control and are not indicative of underlying demand.

Over the last two years, Kontoor Brands failed to grow its constant currency revenue. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Kontoor Brands might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Kontoor Brands’s revenue to rise by 1.6%. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

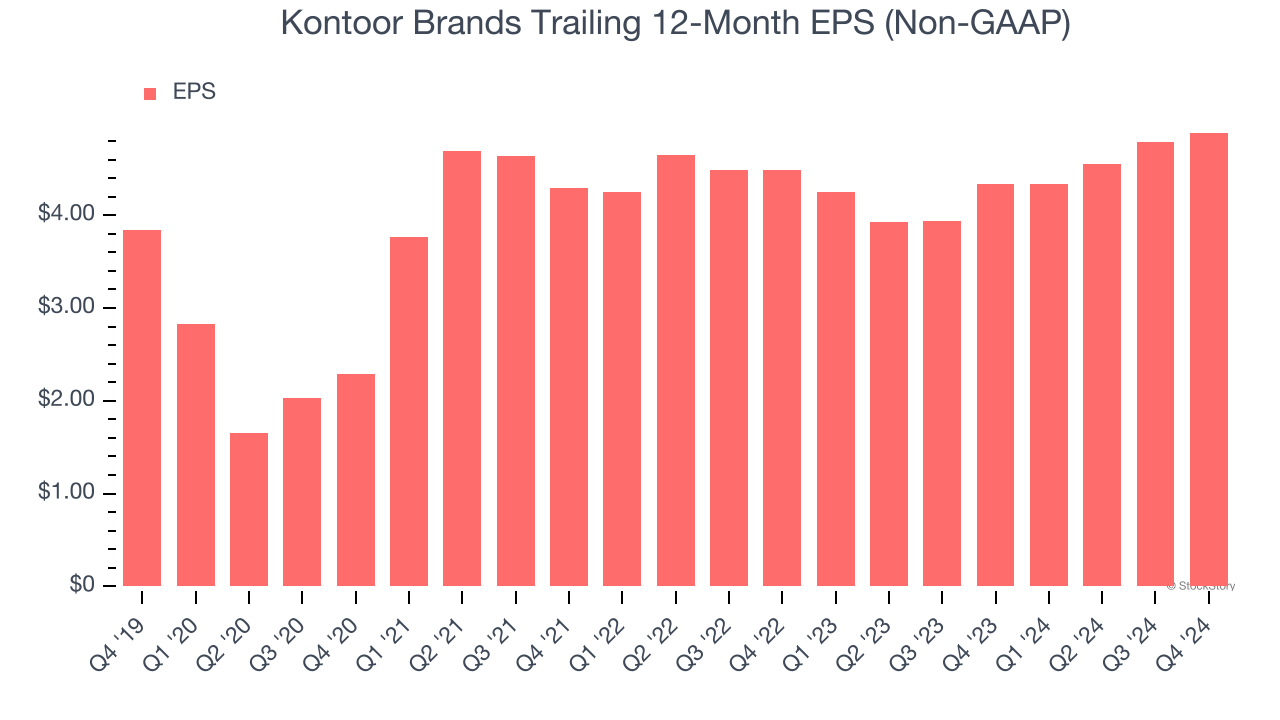

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Kontoor Brands’s EPS grew at an unimpressive 4.9% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

Final Judgment

Kontoor Brands’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 11.1× forward price-to-earnings (or $57.84 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Kontoor Brands

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.