Medical technology company Enovis Corporation (NYSE:ENOV) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 8.6% year on year to $548.9 million. The company expects the full year’s revenue to be around $2.26 billion, close to analysts’ estimates. Its non-GAAP profit of $0.75 per share was 15.6% above analysts’ consensus estimates.

Is now the time to buy Enovis? Find out by accessing our full research report, it’s free for active Edge members.

Enovis (ENOV) Q3 CY2025 Highlights:

- Revenue: $548.9 million vs analyst estimates of $537.6 million (8.6% year-on-year growth, 2.1% beat)

- Adjusted EPS: $0.75 vs analyst estimates of $0.65 (15.6% beat)

- Adjusted EBITDA: $94.8 million vs analyst estimates of $92.05 million (17.3% margin, 3% beat)

- The company reconfirmed its revenue guidance for the full year of $2.26 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $3.18 at the midpoint, a 1.6% increase

- EBITDA guidance for the full year is $400 million at the midpoint, above analyst estimates of $395.3 million

- Operating Margin: -102%, down from -6.3% in the same quarter last year

- Free Cash Flow Margin: 5.3%, up from 0.5% in the same quarter last year

- Market Capitalization: $1.8 billion

“We delivered solid results in the third quarter, reflecting continued progress by our teams around the world,” said Damien McDonald, Chief Executive Officer of Enovis.

Company Overview

With a focus on helping patients regain or maintain their natural motion, Enovis (NYSE:ENOV) develops and manufactures medical devices for orthopedic care, from injury prevention and pain management to joint replacement and rehabilitation.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Enovis’s demand was weak and its revenue declined by 6.5% per year. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Enovis’s annualized revenue growth of 16% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Enovis reported year-on-year revenue growth of 8.6%, and its $548.9 million of revenue exceeded Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and implies the market is baking in some success for its newer products and services.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

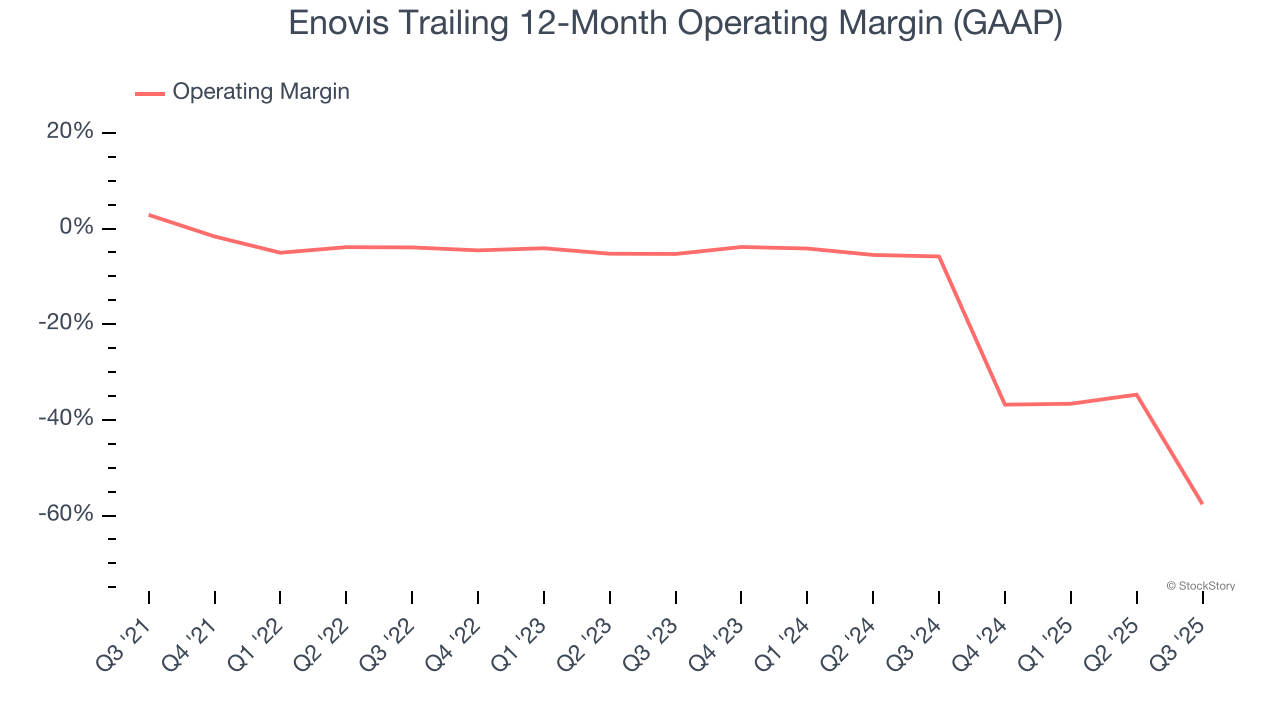

Operating Margin

Enovis’s high expenses have contributed to an average operating margin of negative 16.1% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Enovis’s operating margin decreased by 60.5 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 52.3 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Enovis generated a negative 102% operating margin. The company's consistent lack of profits raise a flag.

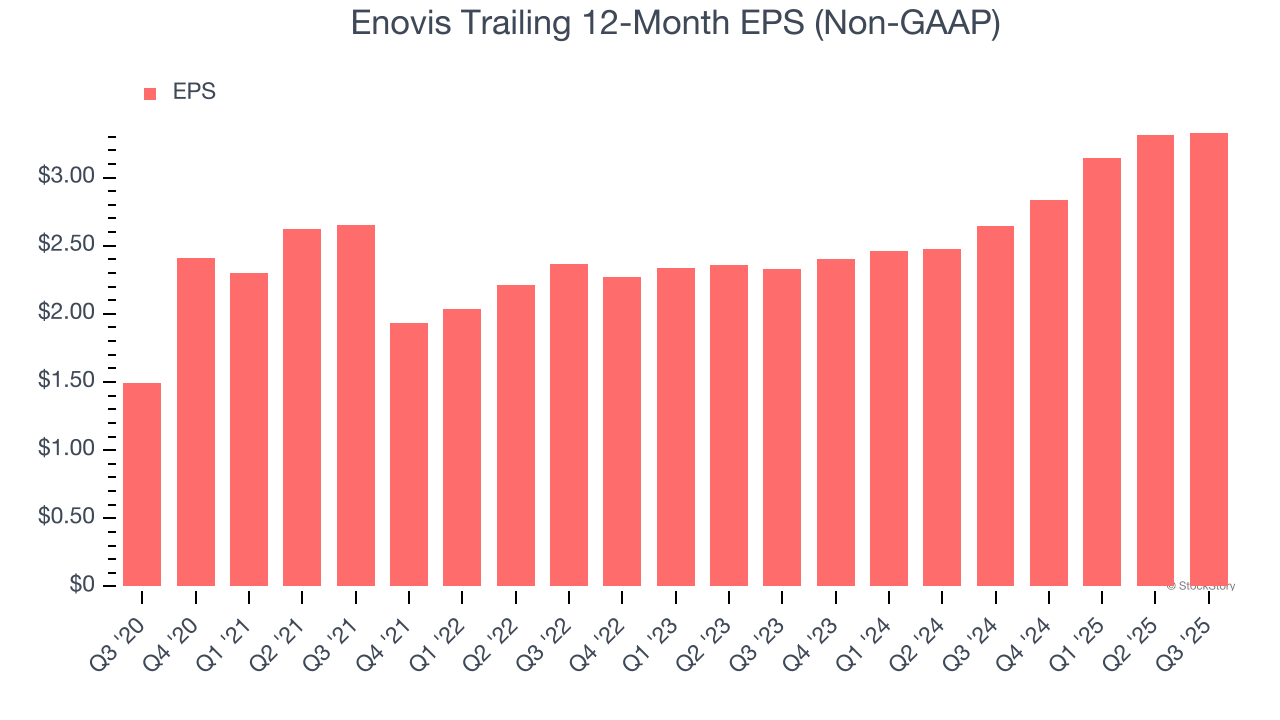

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Enovis’s EPS grew at an astounding 17.4% compounded annual growth rate over the last five years, higher than its 6.5% annualized revenue declines. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q3, Enovis reported adjusted EPS of $0.75, up from $0.73 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Enovis’s full-year EPS of $3.33 to stay about the same.

Key Takeaways from Enovis’s Q3 Results

It was good to see Enovis beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $31.50 immediately after reporting.

So do we think Enovis is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.