Biotech company 10x Genomics (NASDAQ:TXG) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 1.7% year on year to $149 million. On top of that, next quarter’s revenue guidance ($156 million at the midpoint) was surprisingly good and 3.5% above what analysts were expecting. Its GAAP loss of $0.22 per share was 22.3% above analysts’ consensus estimates.

Is now the time to buy 10x Genomics? Find out by accessing our full research report, it’s free for active Edge members.

10x Genomics (TXG) Q3 CY2025 Highlights:

- Revenue: $149 million vs analyst estimates of $142.4 million (1.7% year-on-year decline, 4.6% beat)

- EPS (GAAP): -$0.22 vs analyst estimates of -$0.28 (22.3% beat)

- Revenue Guidance for Q4 CY2025 is $156 million at the midpoint, above analyst estimates of $150.7 million

- Operating Margin: -21.6%, up from -27.4% in the same quarter last year

- Market Capitalization: $1.68 billion

"Our team delivered a solid third quarter, and we continue to see notable enthusiasm for our single cell and spatial products," said Serge Saxonov, Co-founder and CEO of 10x Genomics.

Company Overview

Founded in 2012 by scientists seeking to overcome limitations in traditional biological research methods, 10x Genomics (NASDAQ:TXG) develops instruments, consumables, and software that enable researchers to analyze biological systems at single-cell resolution and spatial context.

Revenue Growth

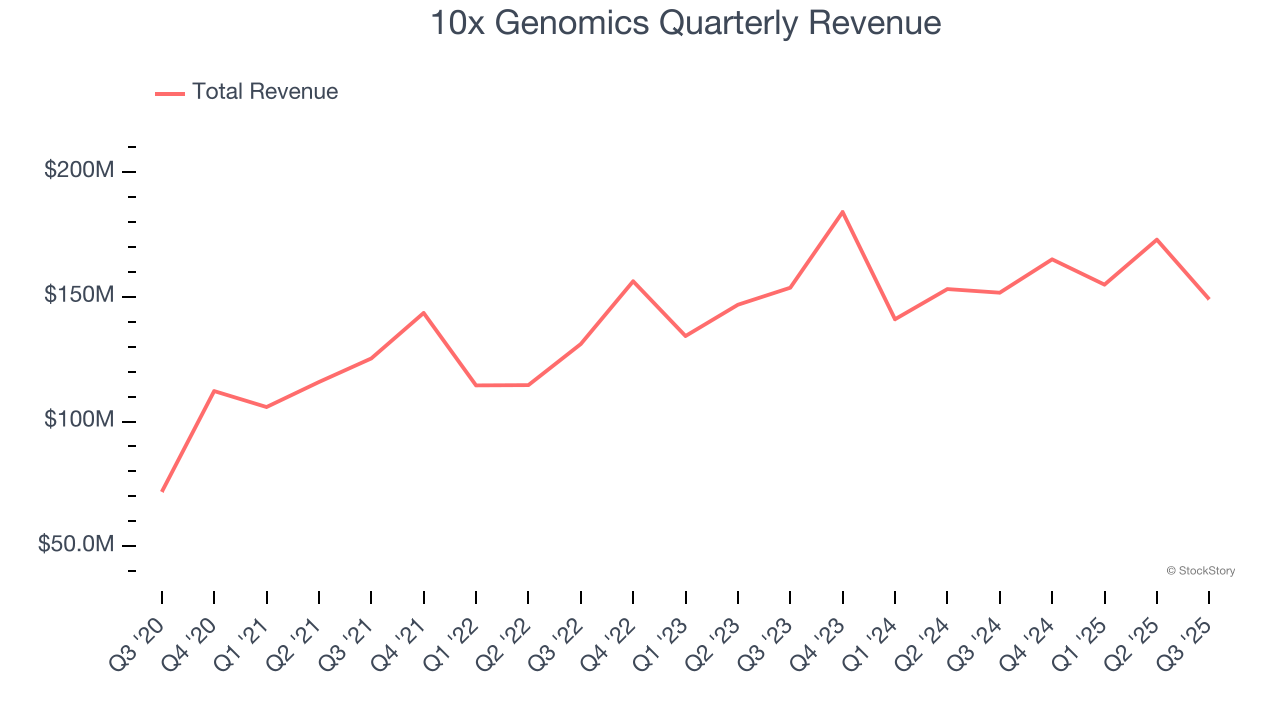

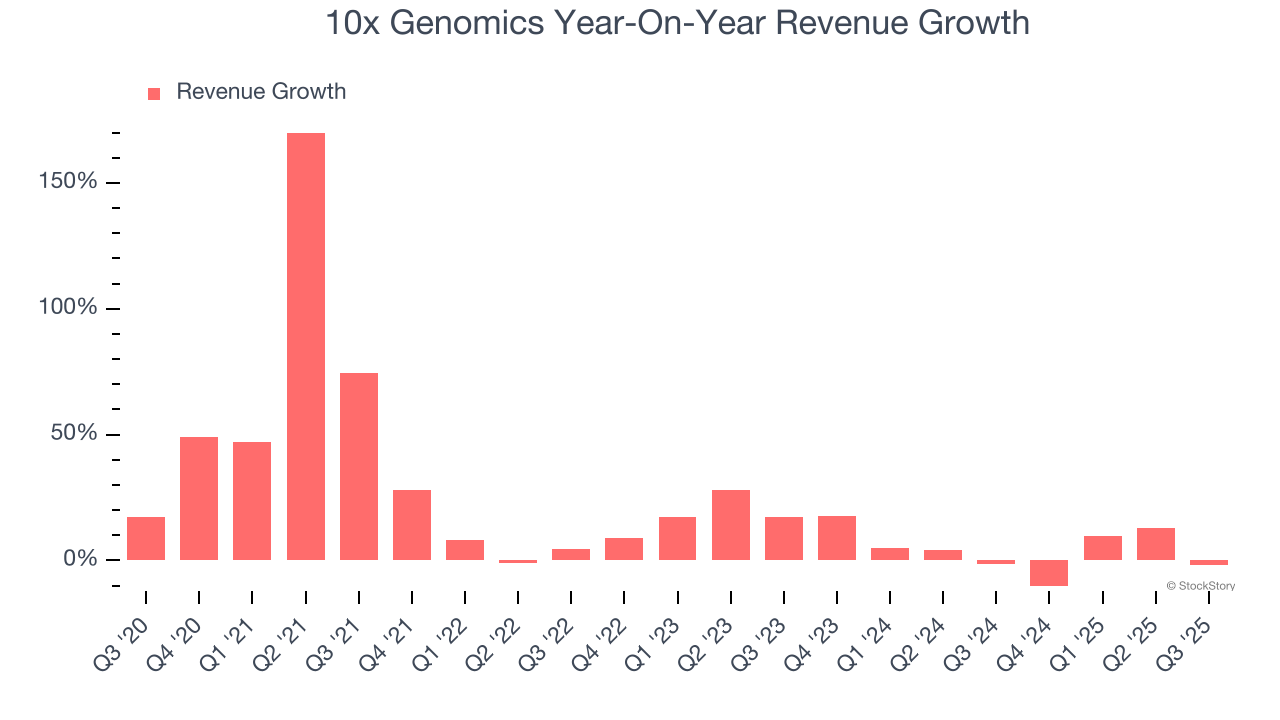

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, 10x Genomics grew its sales at an impressive 19.6% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. 10x Genomics’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 4.2% over the last two years was well below its five-year trend.

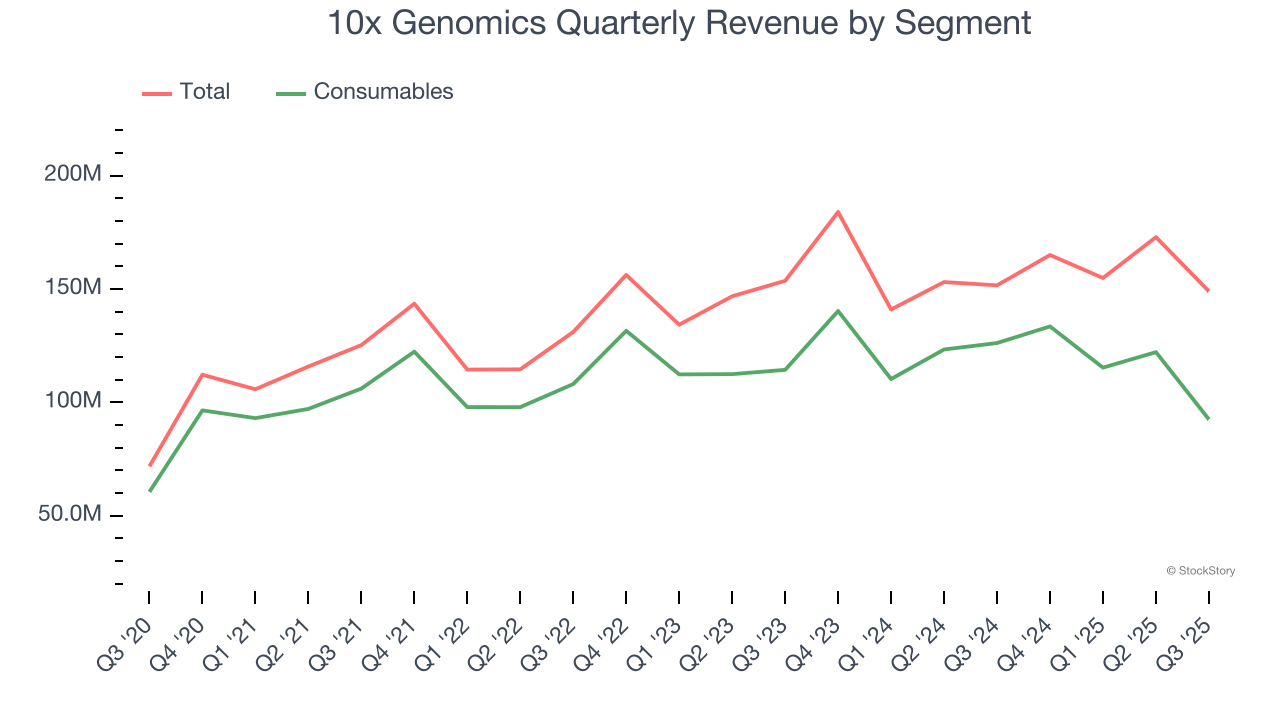

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Consumables. Over the last two years, 10x Genomics’s Consumables revenue (recurring orders) was flat. This segment has lagged the company’s overall sales.

This quarter, 10x Genomics’s revenue fell by 1.7% year on year to $149 million but beat Wall Street’s estimates by 4.6%. Company management is currently guiding for a 5.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 7.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

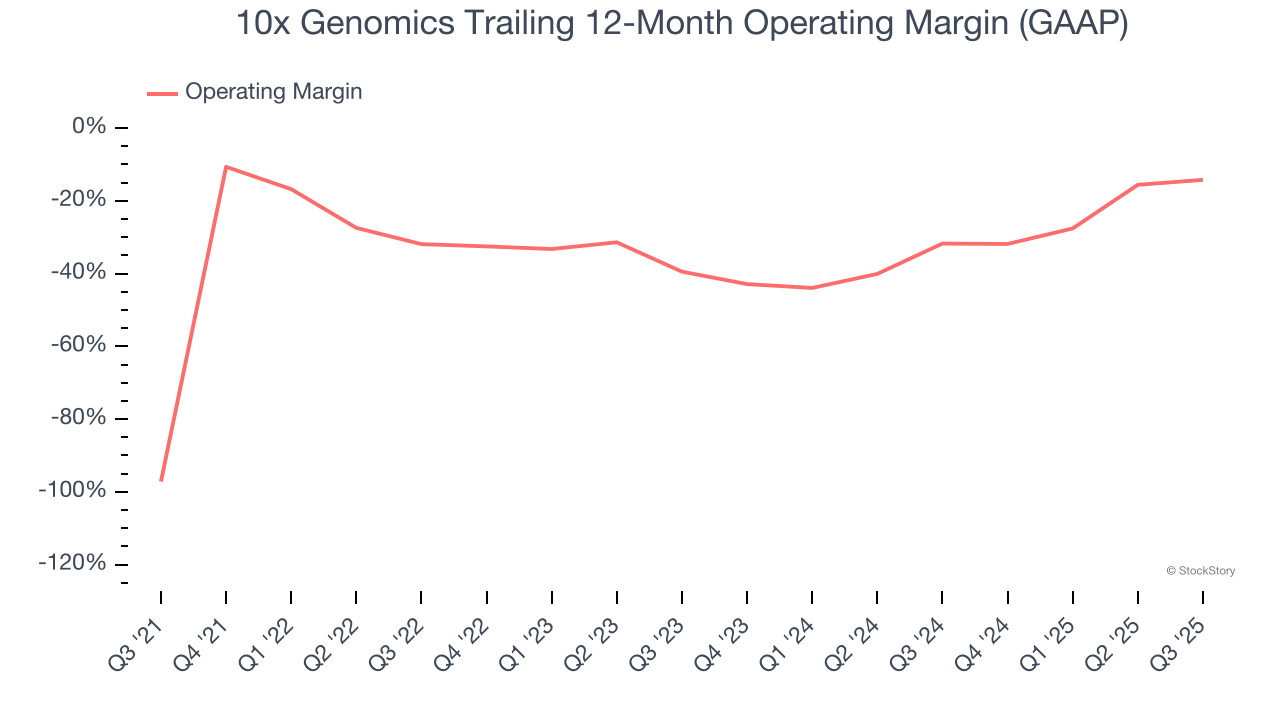

10x Genomics’s high expenses have contributed to an average operating margin of negative 40% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, 10x Genomics’s operating margin rose by 82.9 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 25.2 percentage points on a two-year basis.

In Q3, 10x Genomics generated a negative 21.6% operating margin.

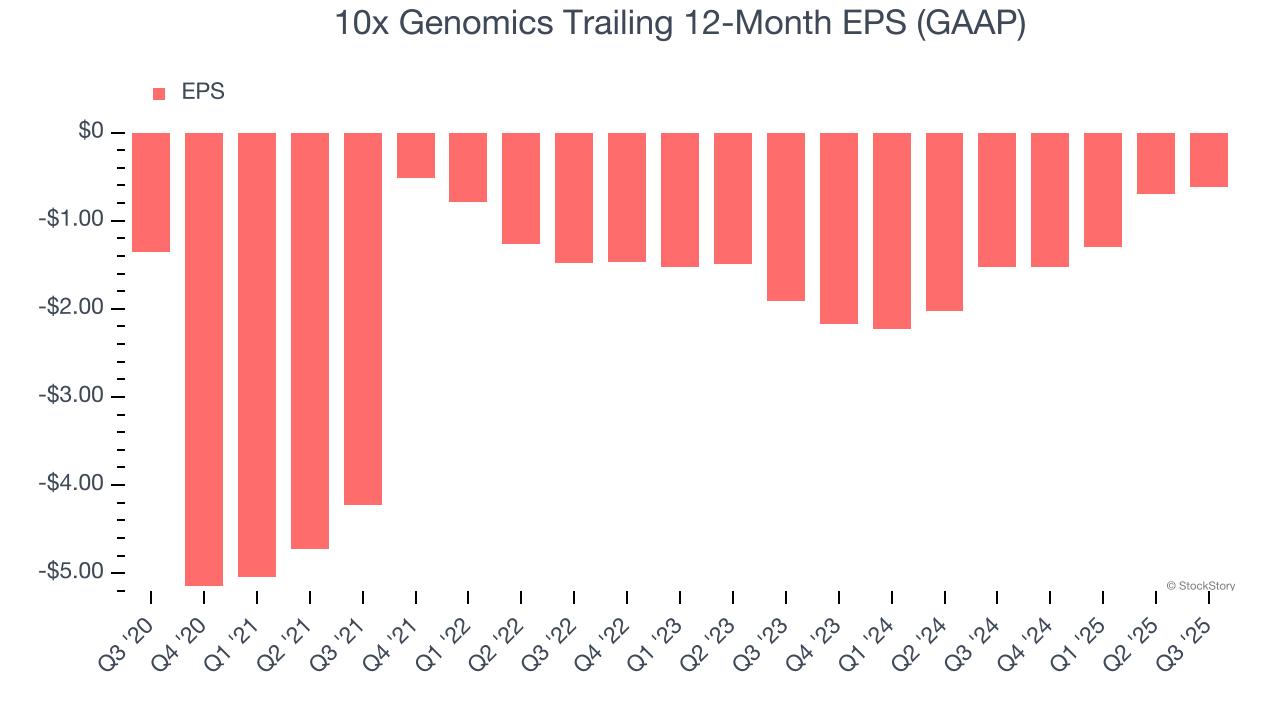

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although 10x Genomics’s full-year earnings are still negative, it reduced its losses and improved its EPS by 14.4% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q3, 10x Genomics reported EPS of negative $0.22, up from negative $0.30 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects 10x Genomics to perform poorly. Analysts forecast its full-year EPS of negative $0.62 will tumble to negative $1.00.

Key Takeaways from 10x Genomics’s Q3 Results

It was great to see 10x Genomics’s revenue guidance for next quarter top analysts’ expectations. We were also glad this quarter's revenue and EPS outperformed Wall Street’s estimates. Zooming out, we think this print featured some important positives. The stock traded up 13.1% to $14.69 immediately after reporting.

Indeed, 10x Genomics had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.