Maritime shipping company Genco (NYSE:GNK) announced better-than-expected revenue in Q3 CY2025, with sales up 13% year on year to $79.92 million. Its non-GAAP loss of $0.01 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Genco? Find out by accessing our full research report, it’s free for active Edge members.

Genco (GNK) Q3 CY2025 Highlights:

- Revenue: $79.92 million vs analyst estimates of $56.94 million (13% year-on-year growth, 40.4% beat)

- Adjusted EPS: -$0.01 vs analyst estimates of $0.09 (significant miss)

- Adjusted EBITDA: $21.7 million vs analyst estimates of $24.84 million (27.1% margin, 12.7% miss)

- Operating Margin: 3.1%, down from 34% in the same quarter last year

- Free Cash Flow was -$2.25 million, down from $32.12 million in the same quarter last year

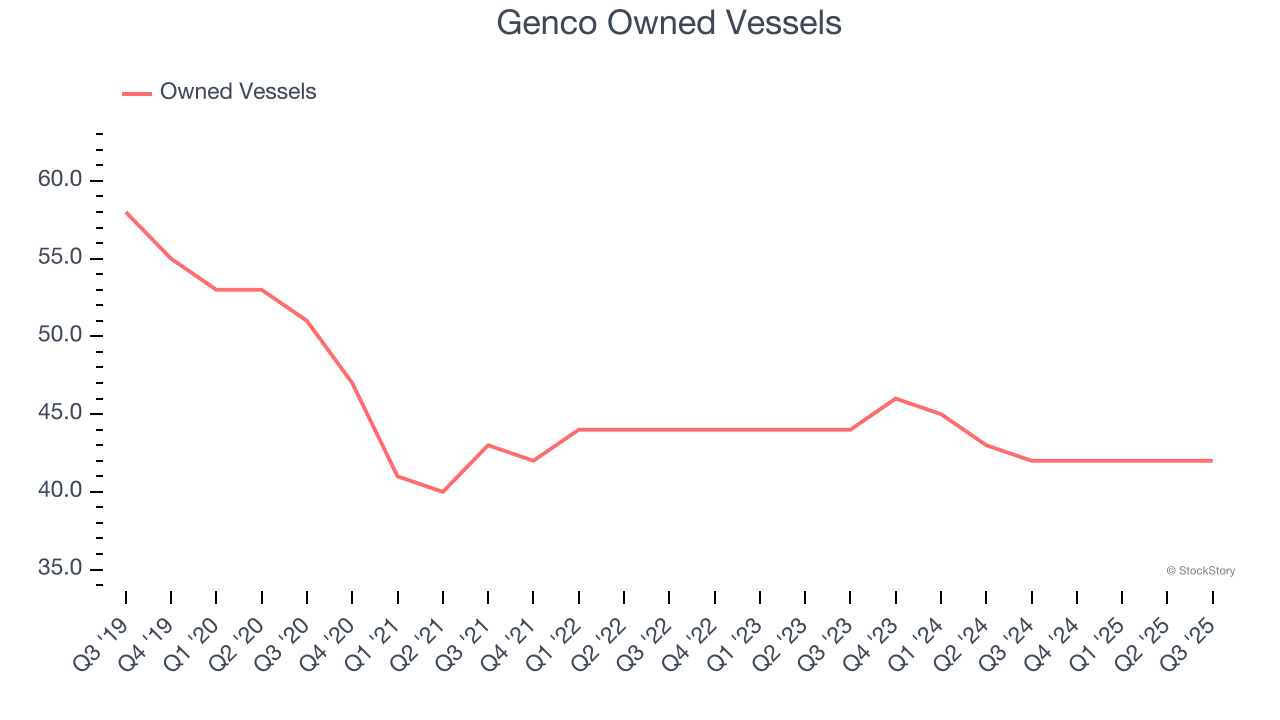

- owned vessels: 42, in line with the same quarter last year

- Market Capitalization: $707.5 million

John C. Wobensmith, Chief Executive Officer, commented, “During the third quarter, Genco’s execution of its value strategy was once again strong, as we declared our 25th consecutive dividend and grew our high-specification Capesize fleet. Including the third quarter, these dividends have now totaled $7.065 per share, or approximately 43% of our current share price. As part of our value strategy, we have also paid down $279 million in debt since the strategy’s inception and invested approximately $200 million in modern Capesize vessels since 2023.”

Company Overview

Headquartered in NYC, Genco (NYSE:GNK) is a shipping company that transports dry bulk cargo along worldwide maritime routes.

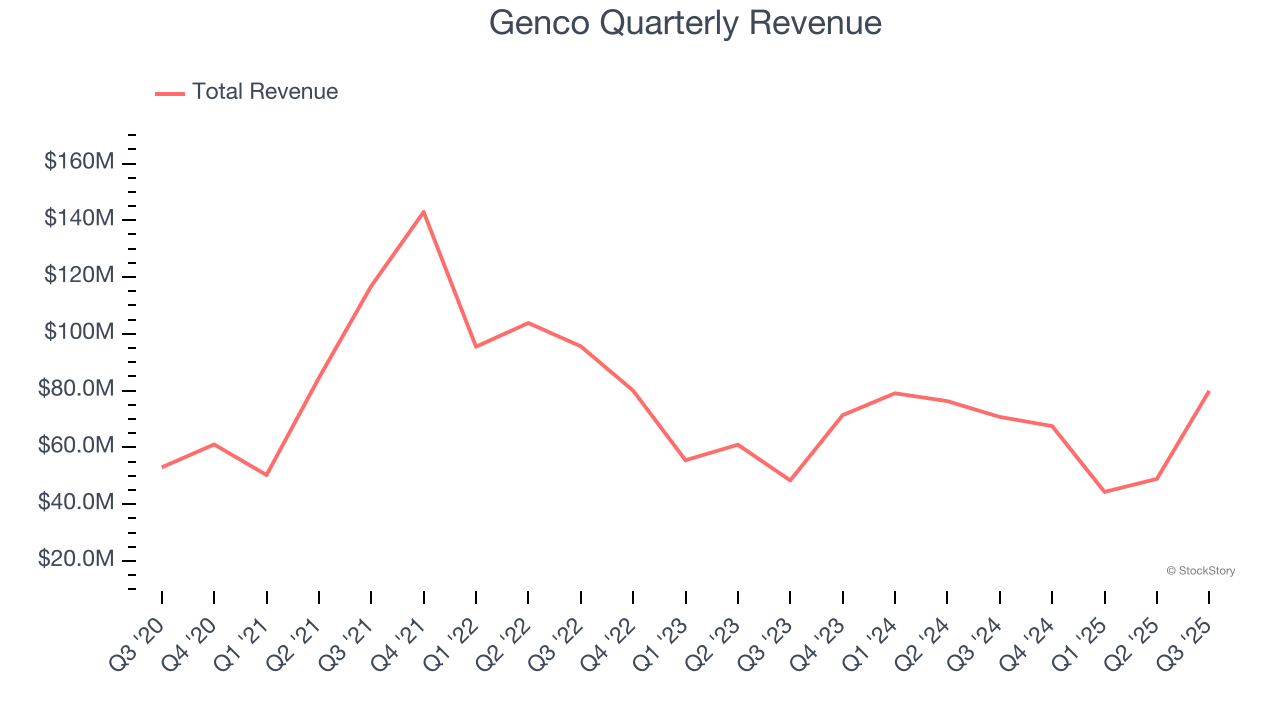

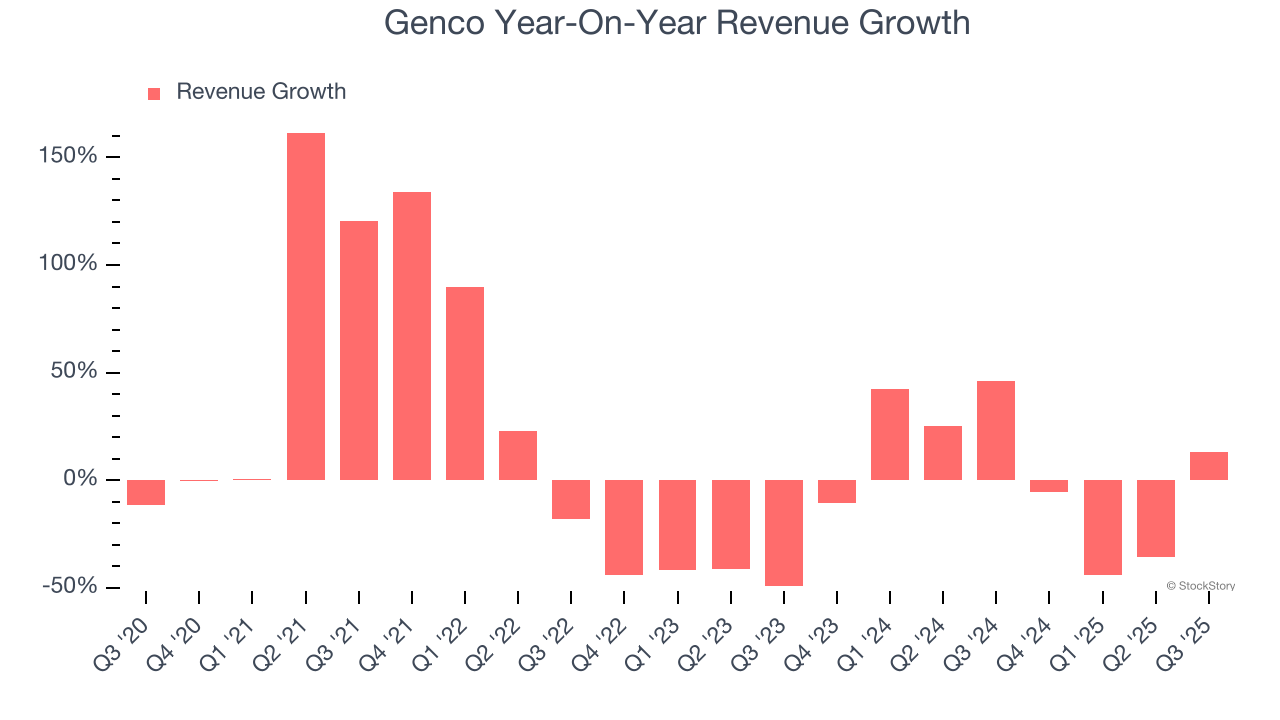

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Genco grew its sales at a sluggish 4.1% compounded annual growth rate. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Genco’s recent performance shows its demand has slowed as its revenue was flat over the last two years. We also note many other Marine Transportation businesses have faced declining sales because of cyclical headwinds. While Genco’s growth wasn’t the best, it did do better than its peers.

Genco also discloses its number of owned vessels, which reached 42 in the latest quarter. Over the last two years, Genco’s owned vessels averaged 2.2% year-on-year declines. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, Genco reported year-on-year revenue growth of 13%, and its $79.92 million of revenue exceeded Wall Street’s estimates by 40.4%.

Looking ahead, sell-side analysts expect revenue to grow 11.7% over the next 12 months, an improvement versus the last two years. This projection is commendable and suggests its newer products and services will catalyze better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Genco has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 24.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Genco’s operating margin decreased by 13.7 percentage points over the last five years. Many Marine Transportation companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction. We hope Genco can emerge from this a stronger company, as the silver lining of a downturn is that market share can be won and efficiencies found.

In Q3, Genco generated an operating margin profit margin of 3.1%, down 30.9 percentage points year on year. Since Genco’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

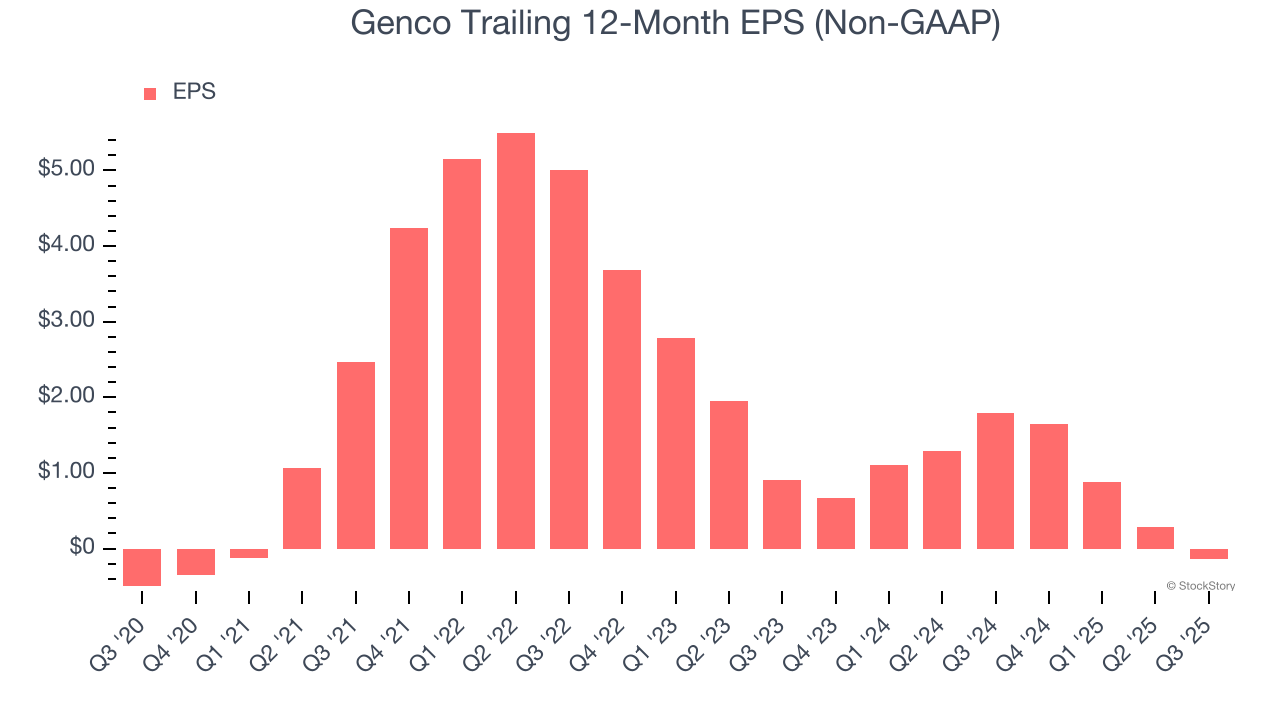

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Genco’s full-year earnings are still negative, it reduced its losses and improved its EPS by 22.9% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Genco, its EPS declined by 46.6% annually over the last two years while its revenue was flat. This tells us the company struggled to adjust to choppy demand.

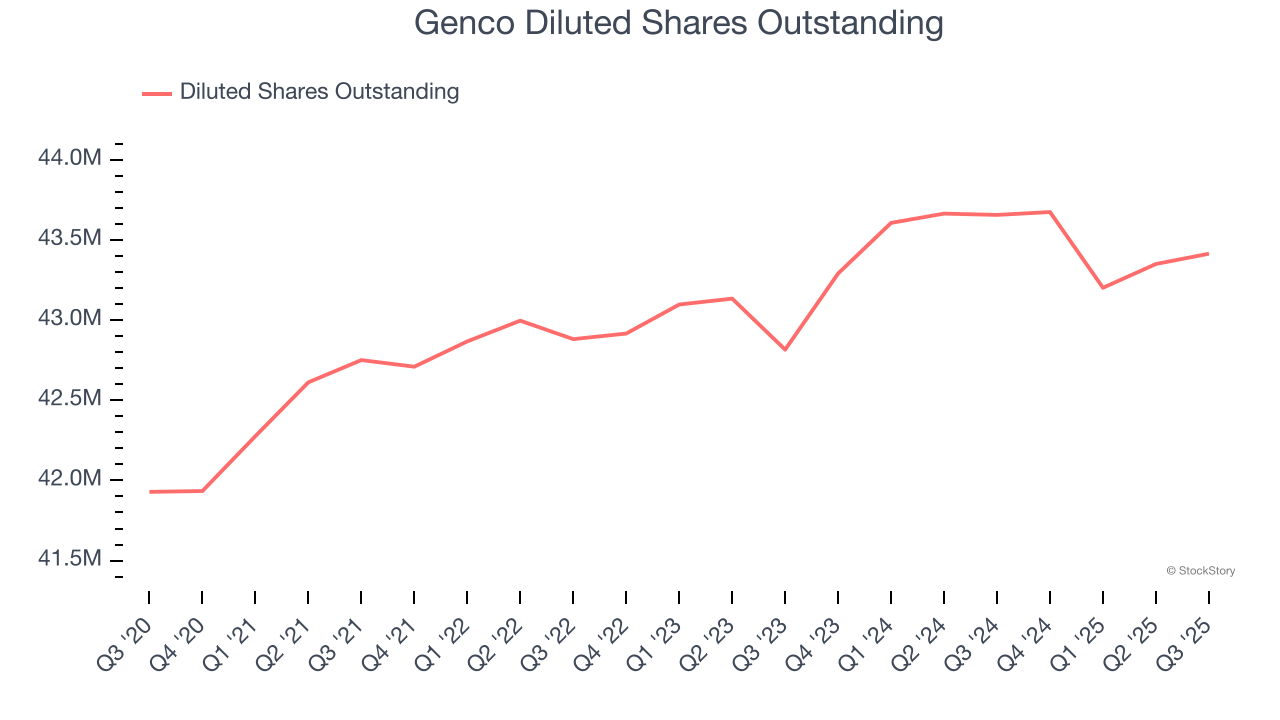

We can take a deeper look into Genco’s earnings to better understand the drivers of its performance. A two-year view shows Genco has diluted its shareholders, growing its share count by 1.4%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings.

In Q3, Genco reported adjusted EPS of negative $0.01, down from $0.41 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Genco’s full-year EPS of negative $0.14 will flip to positive $1.28.

Key Takeaways from Genco’s Q3 Results

We were impressed by how significantly Genco blew past analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 3% to $16.28 immediately following the results.

Genco may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.