Mortgage investment firm Ellington Financial (NYSE:EFC) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 23.6% year on year to $82.76 million. Its non-GAAP profit of $0.53 per share was 20.7% above analysts’ consensus estimates.

Is now the time to buy Ellington Financial? Find out by accessing our full research report, it’s free for active Edge members.

Ellington Financial (EFC) Q3 CY2025 Highlights:

“Robust securitization activity, excellent results from our securities businesses, and continued solid credit performance across our diversified loan businesses, including Longbridge, drove Ellington Financial’s strong results for the quarter,” said Laurence Penn, Chief Executive Officer and President.

Company Overview

Operating under the guidance of Ellington Management Group, a respected name in structured credit markets, Ellington Financial (NYSE:EFC) acquires and manages a diverse portfolio of mortgage-related, consumer-related, and other financial assets to generate returns for investors.

Sales Growth

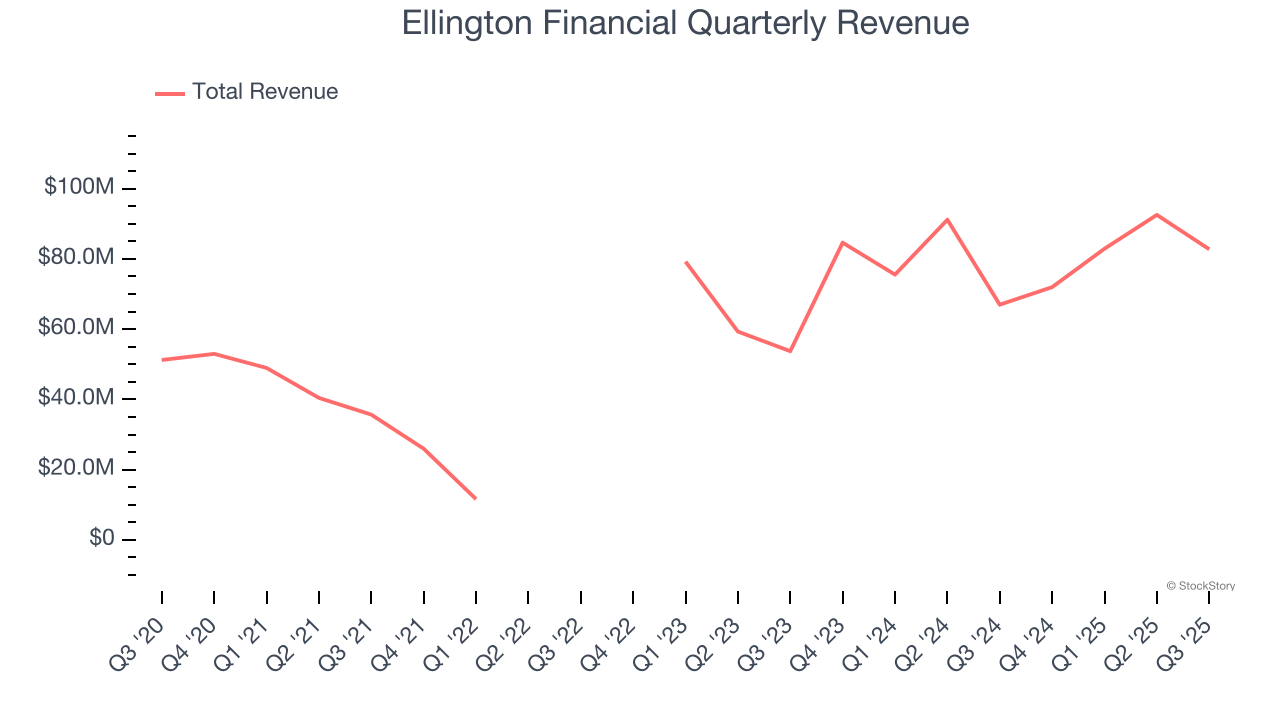

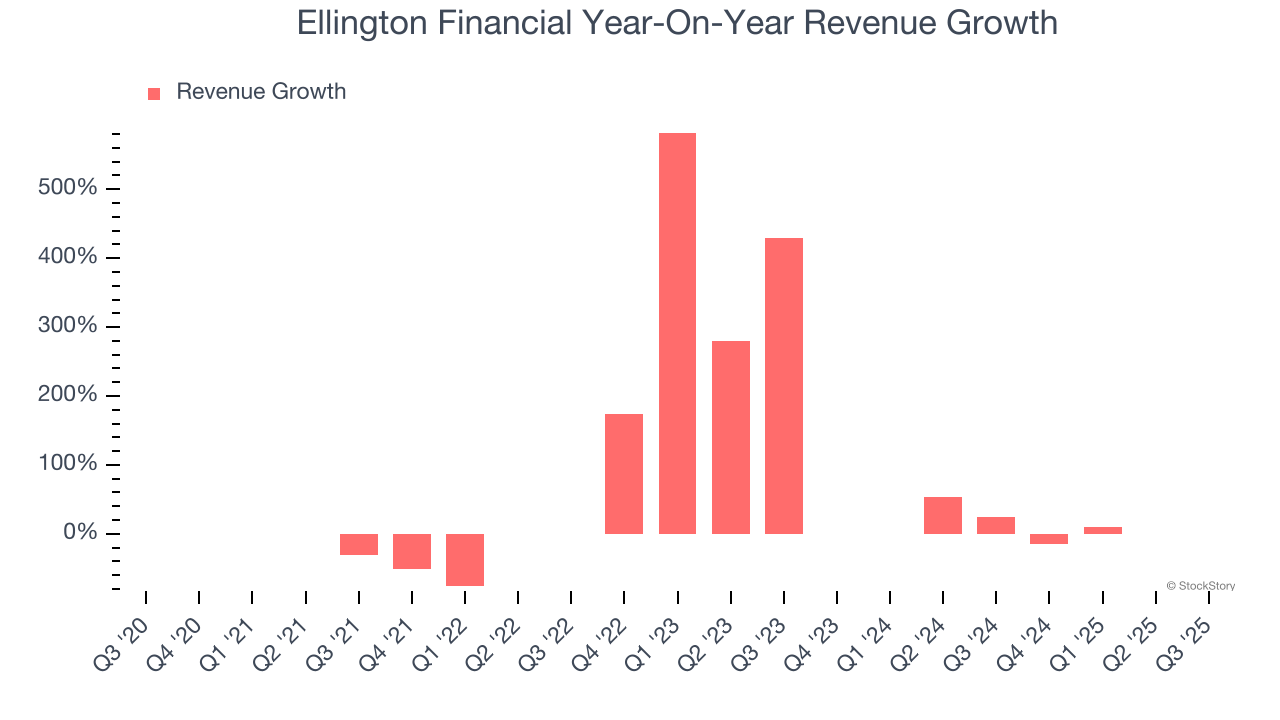

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions. Over the last five years, Ellington Financial grew its revenue at an exceptional 14.8% compounded annual growth rate. Its growth beat the average banking company and shows its offerings resonate with customers.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Ellington Financial’s annualized revenue growth of 12% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Ellington Financial reported robust year-on-year revenue growth of 23.6%, and its $82.76 million of revenue topped Wall Street estimates by 4.9%.

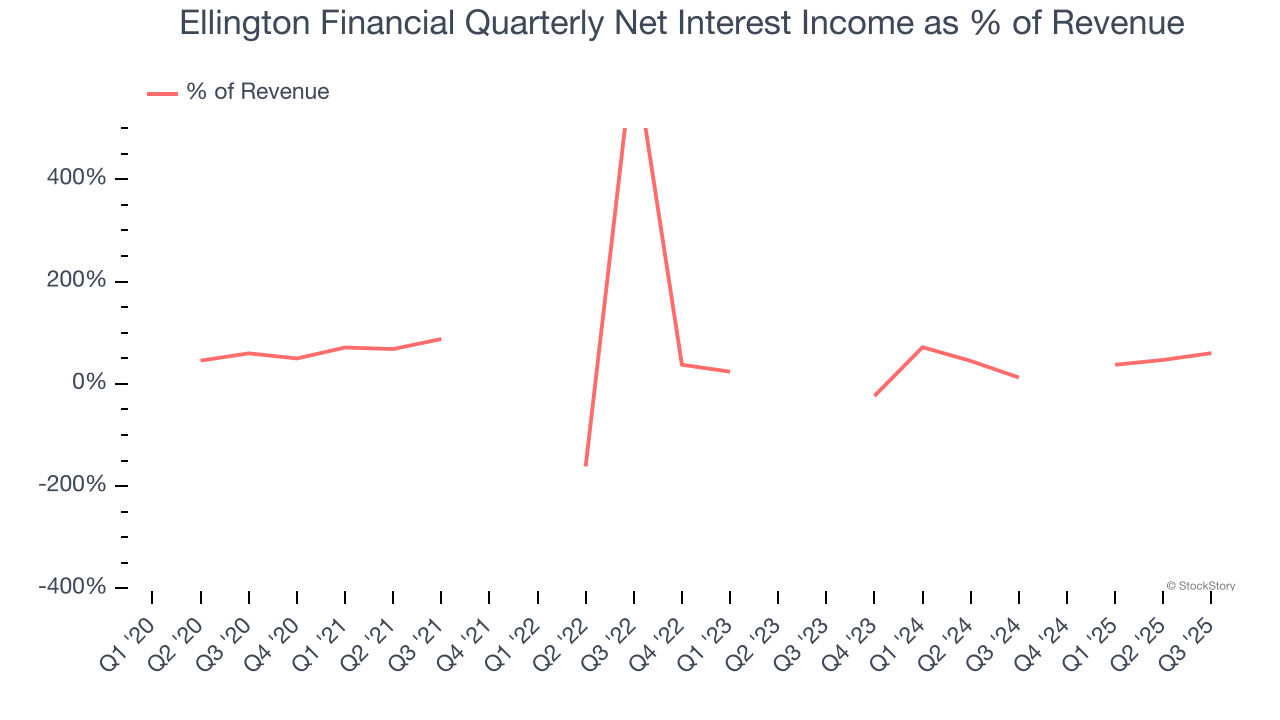

Since the company recorded losses on certain securities, it generated more net interest income than revenue (a 1.1x multiple of its revenue to be exact) during the last five years, meaning Ellington Financial lives and dies by its lending activities because non-interest income barely moves the needle.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.While banks generate revenue from multiple sources, investors view net interest income as the cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of non-interest income.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Key Takeaways from Ellington Financial’s Q3 Results

It was good to see Ellington Financial beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its net interest income was in line. Zooming out, we think this quarter featured some important positives. The stock remained flat at $13.73 immediately following the results.

Ellington Financial had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.