Over the last six months, Insteel’s shares have sunk to $27.99, producing a disappointing 6.7% loss - a stark contrast to the S&P 500’s 9.7% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Insteel, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Even with the cheaper entry price, we're cautious about Insteel. Here are three reasons why you should be careful with IIIN and a stock we'd rather own.

Why Do We Think Insteel Will Underperform?

Growing from a small wire manufacturer to one of the largest in the U.S., Insteel (NYSE:IIIN) provides steel wire reinforcing products for concrete.

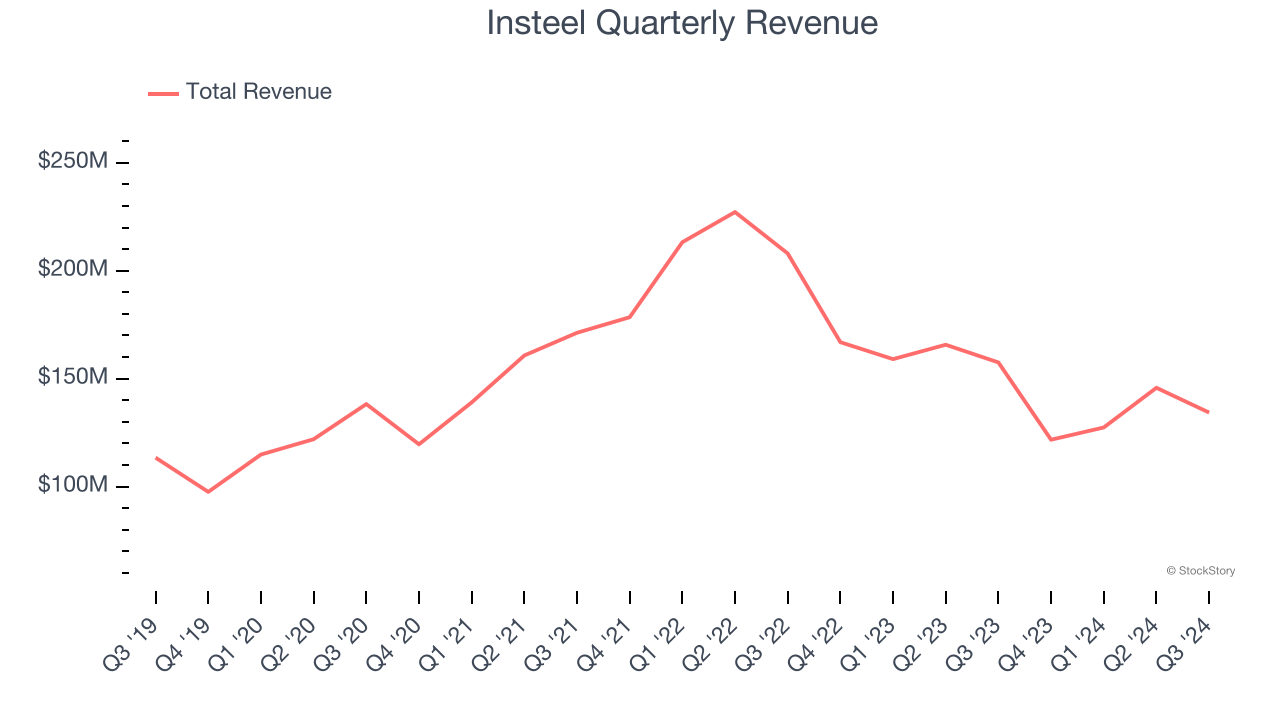

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Insteel grew its sales at a sluggish 3% compounded annual growth rate. This fell short of our benchmarks.

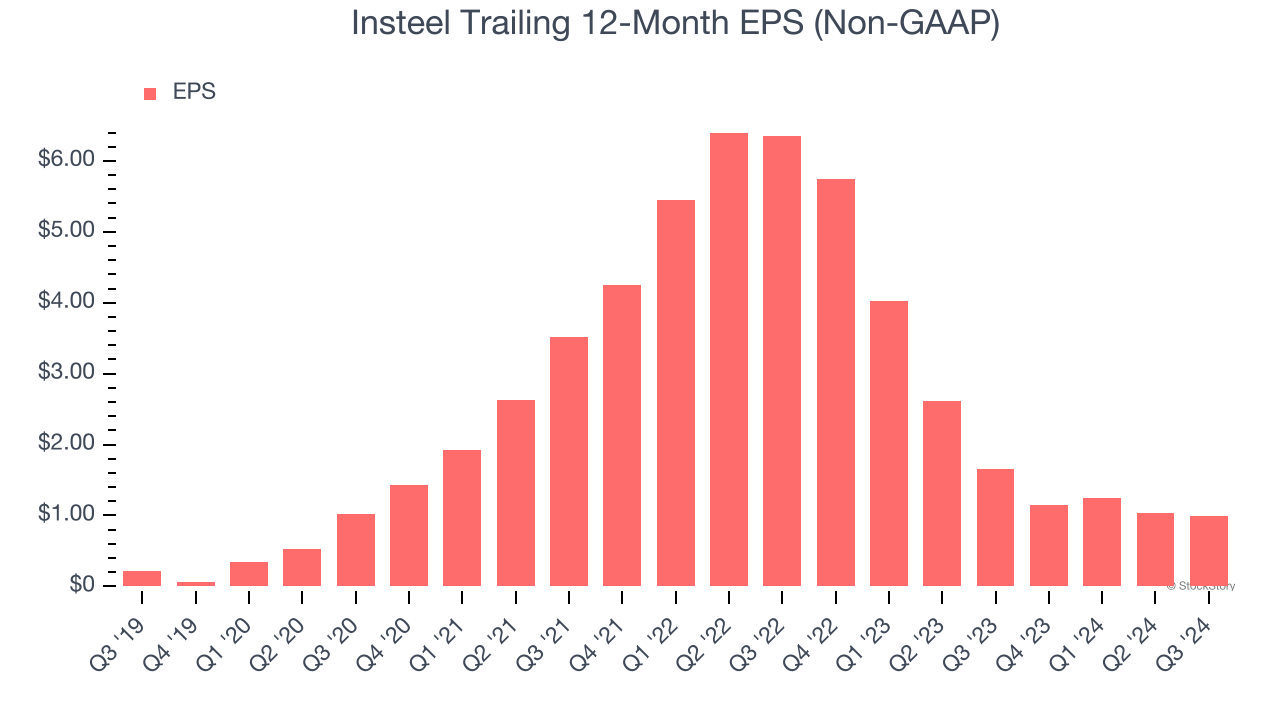

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Insteel, its EPS declined by more than its revenue over the last two years, dropping 60.5%. This tells us the company struggled to adjust to shrinking demand.

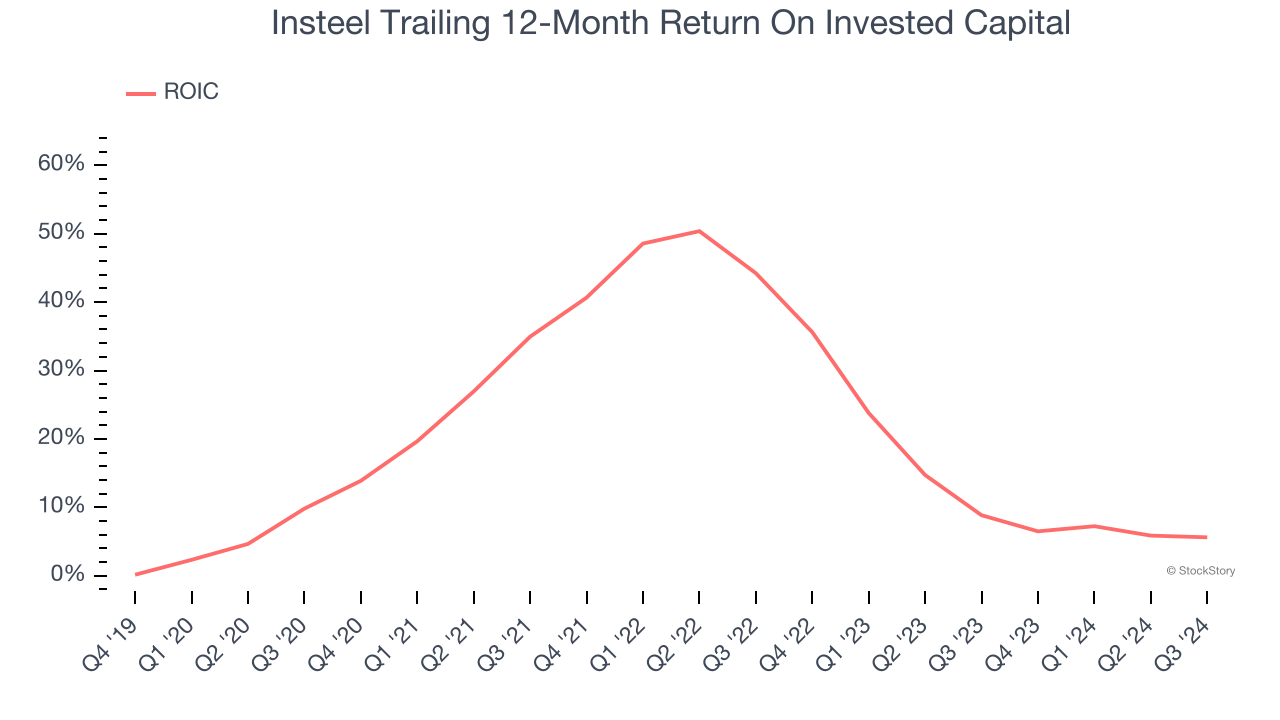

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Insteel’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We see the value of companies helping their customers, but in the case of Insteel, we’re out. After the recent drawdown, the stock trades at 13.8× forward price-to-earnings (or $27.99 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are superior stocks to buy right now. Let us point you toward TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Insteel

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.