Fidelity National Information Services, Inc. (FIS) is a leading American multinational headquartered in Jacksonville, Florida, providing financial technology solutions to over 20,000 clients worldwide, including banks, asset managers, and businesses. Its market capitalization currently stands at $33 billion.

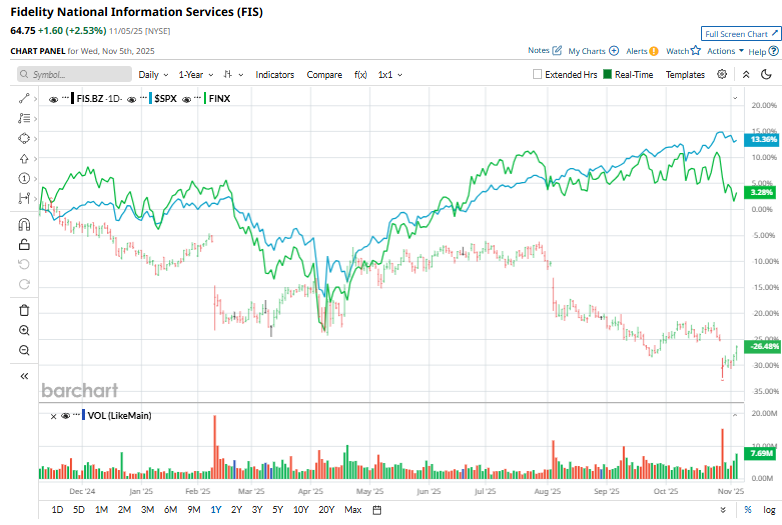

Shares of the fintech giant have struggled to keep up with the broader market over the past year. FIS has declined 25.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 17.5%. Moreover, in 2025, FIS stock is down 19.8%, compared to the SPX’s 15.6% rise on a YTD basis.

Zooming in further, FIS has also underperformed the Global X FinTech ETF (FINX). The exchange-traded fund has gained 11% over the past year and 4.9% in 2025.

FIS shares climbed 2.5% on Nov. 5 after delivering solid third-quarter earnings. Its revenue soared 6% year over year to $2.7 billion, and adjusted EPS rose 8% to $1.51, exceeding expectations. The company expanded its adjusted EBITDA margin by approximately 53 basis points to 41.8%. Following the strong results, FIS also lifted its full-year 2025 outlook, now expecting revenue to grow between approximately 5.4% and 5.7%.

For the current fiscal year, which ends in December, analysts expect FIS’ EPS to grow 10.3% to $5.76 on a diluted basis. The company’s earnings surprise history is solid. It beat or met the consensus estimate in each of the last four quarters.

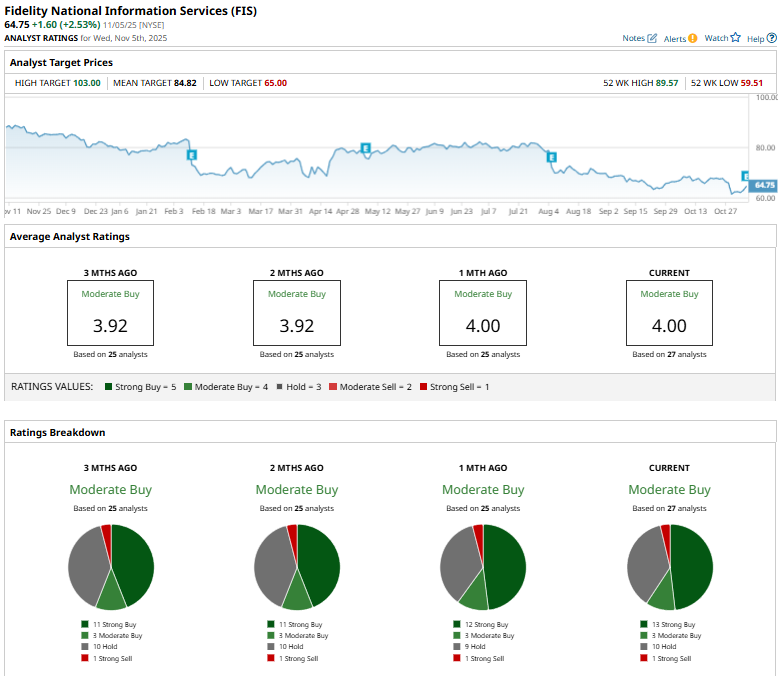

Among the 27 analysts covering FIS stock, the consensus is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, three “Moderate Buys,” ten “Holds,” and one “Strong Sell.”

This configuration is more bearish than one month ago, with 12 analysts suggesting a “Strong Buy.”

On Oct. 24, Truist Securities’ analyst Matthew Coad reaffirmed a “Hold” rating on Fidelity National Information Services but cut the price target from $75 to $72, marking a 4% reduction.

The mean price target of $84.82 represents a 31% premium to FIS’ current price levels. The Street-high price target of $103 suggests an ambitious upside potential of 59.1%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart