Advanced Micro Devices (AMD) is currently showing above average volatility with an IV Percentile of 80% and an IV Rank of 43.04%.

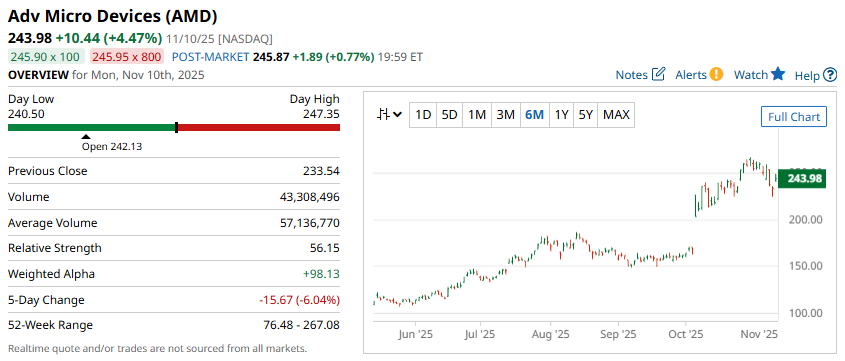

The stock has been trading between 200 and 270 for the last few weeks.

COMPANY DETAILS

Advanced Micro Devices offers the industry's broadest portfolio of leadership high-performance and adaptive processor technologies, combining CPUs, GPUs, FPGAs, Adaptive SoCs and deep software expertise to enable leadership computing platforms for cloud, edge and end devices.

Today, we’re going to look at a short strangle trade due to the high IV percentile, that will profit if AMD stays between 195 and 285 for the next two months.

A short strangle aims to profit from a drop in implied volatility, with the stock staying within an expected range.

When implied volatility is high, the wider the expected range becomes.

The maximum profit for a short strangle is limited to the premium received while the maximum potential loss is unlimited. For this reason, the strategy is not suitable for beginners.

AMD SHORT STRANGLE

Traders that think AMD stock might remain stable over the next few weeks could look at a short strangle.

As a reminder, a short strangle is a combination of an out-of-the-money short put and an out-of-the-money short call.

The idea with the trade is to profit from time decay while expecting that the stock will not move too much in either direction.

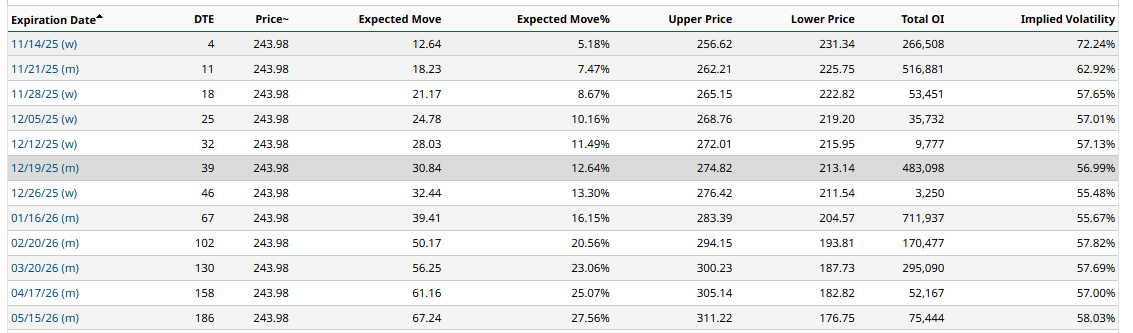

For AMD stock, a December 19 put with a strike price of $210 could be sold for around $4.95.

Then the short call, placed at the $270 strike, could be sold for around $9.20.

In total, the short strangle will generate around $14.15 per contract or $1,415 of premium.

The profit zone ranges between $195.85 and $284.15. This can be calculated by taking the short strikes and adding or subtracting the premium received.

If price action stabilizes, then short strangles will work well. However, if AMD stock makes a bigger than expected move, the trade will suffer losses.

Note that AMD has already reported Q3 earnings, so this trade should not have any earnings risk if held to expiration.

The expected move for the December 19 expiration is currently $213.14 – $274.82

Conclusion And Risk Management

One way to set a stop loss for a short strangle is based on the premium received. In this case, we received $1,415, so we could set a stop loss equal to the premium received, or a loss of around $1,415.

Another way to manage the trade is to set a point on the chart where the trade will be adjusted or closed. That could be around $210 on the downside and $260 on the upside.

As this trade encompasses earnings, there is a chance the stock could gap above or below those points.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AMD Short Strangle Could Net $1400 in a Few Weeks

- Options Traders Bet Beyond Meat Stock Could Move 30% When It Posts Delayed Q3 Earnings This Week

- Airbnb Keeps Generating Strong FCF and FCF Margins and Could Be 15% -20% Too Cheap

- Despite an Earnings Miss, Super Micro Computer’s (SMCI) Options Flow Points to a Potential Reversal